By Dividend Sensei

- ETFs are a great way for anyone to put savings to work who doesn’t have the experience, interest, time or temperament to own individual companies.

- A 25% to 50% core ETF portfolio can be combined with individual companies bought at reasonable or attractive prices, to tailor a portfolio that fits your needs.

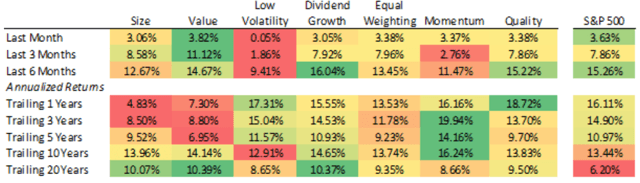

- There are seven proven smart beta strategies that consistently beat the market over time. Quality, value, dividend growth and low volatility are the four that work great together.

- VOE, USMV, SDY, SPHQ, SPHD, and OUSA are six great smart beta ETFs that can make up the core of a diversified and properly risk-managed portfolio that can deliver above-average yield and better total returns over time.

- This article explains how each is built, what it owns, its strengths and weaknesses, how its risk profile looks, and what kind of long-term returns you can expect if you buy today.

How ETFs Can Help You Build A Better Portfolio

While the essence of what I do on Seeking Alpha and at the Dividend Kings is recommending individual companies, that doesn’t mean that ETFs can’t serve a valuable function for long-term investors in two main ways. First, for any asset class that’s outside your circle of competence (such as preferred stock, bonds, foreign companies, etc) ETFs are a great hands-off way to gain diversified exposure. Second, and more powerfully, for anyone starting out constructing a diversified and properly risk-managed portfolio, ETFs can make great core holdings. Rather than rush to build a diversified portfolio using reasonable risk management guidelines, you can start out with 25% to 50% of your savings in one or more ETFs and then patiently build out your individual stock portfolio.

But knowing what ETFs are worth owning at all isn’t so easy. There are more than 2,000 ETFs available in the US (and 5,000 worldwide). So this article is meant to highlight six quality ones I can recommend as core holdings that can hopefully help you build the right portfolio for your needs.

(Source: Ploutos) as of November 2019

The Power Of Smart Beta ETFs

There are seven time tested approaches to generating alpha, and you don’t necessarily have to use all of them. Frazzini, Kabiller, and Pederson (2018) found that nearly all of Warren Buffet’s public stock performance at Berkshire Hathaway can be explained by exposure to the quality, value, and low beta factors.”