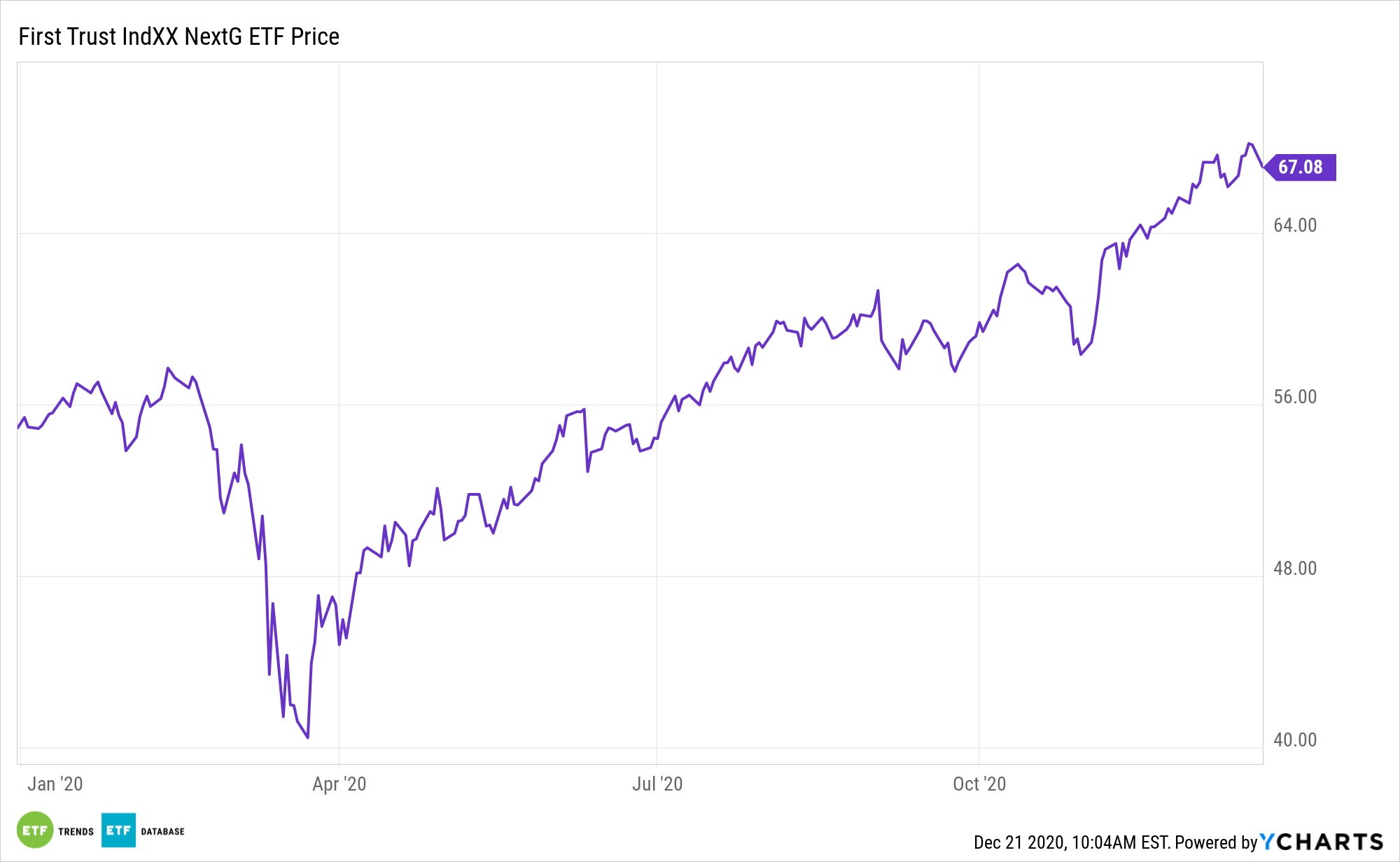

The 5G rollout was one of 2020’s biggest technology themes and one that spotlighted opportunities with exchange traded funds such as the First Trust Indxx NextG ETF (NXTG).

The First Trust Indxx NextG ETF, formerly First Trust Nasdaq Smartphone Index Fund, seeks investment results that correspond generally to the price and yield (before the Fund’s fees and expenses) of an equity index called the Indxx 5G & NextG Thematic Index SM. The Fund will normally invest at least 90% of its net assets (including investment borrowings) in the common stocks and depositary receipts that comprise the Index.

5G is often framed as a 2020 theme, but the reality is, this is a multi-year concept, meaning NXTG could be in the early innings of outperforming other thematic funds. In fact, the longer-ranging case for NXTG is bolstered by 5G’s intersection with a slew of disruptive technologies that are in the early stages of their advancement.

“But for investors looking to capitalize on the shift to fifth-generation mobile network technology, the global rollout is still in the early stages,” reports Business Insider. “According to a study conducted by IHS Markit, the applications of 5G technology are expected to generate $13.2 trillion of economic value worldwide by 2035.”

NXTG: Fantastic 5G Idea

Unlike previous generations of wireless technology, 5G represents a giant leap forward in potential applications — enabling data-intensive processes to be implemented anywhere at broadband speeds. Such functions include real-time communication among autonomous vehicles, AI integrated robotic devices for remote surgeries, smart cities, and sensors optimized for energy conservation within homes.

“Among the many stocks that have massively benefitted from the coronavirus-induced stay-at-home mandate, 5G stocks are top of the list because of the super-fast remote connectivity it promises in the future,” according to Business Insider.

The concept is that 5G will be ubiquitous, and someday gadgets like your vacuum cleaner or lawnmower might use 5G. It’s often claimed to be one of the most important milestones in technology, with companies like Verizon creating ads that suggest, it offers “unprecedented power” for consumers. 5G will be more reliable, faster, and pervasive.

NXTG’s index is designed to track the performance of companies that have devoted, or have committed to devote, material resources to the research, development, and application of fifth generation (“5G”) and next-generation digital cellular technologies as they emerge.

Eligible securities must have a minimum market capitalization of $500 million, the six-month average daily trading volume of at least $2 million ($1 million for emerging market companies), traded for at least 90% of the total trading days in the last six months or for a security recently issued in an initial public offering over the prior three months, a minimum free float of 10% of shares outstanding, and a share price of less than $10,000 for new index constituents.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.