Certain ETF products that focus on certain assets like commodities or derivatives could have different tax implications attached to the fund depending on its structure. An investor should seek tax assistance prior to investing in these funds in order to gain an understanding of the tax ramifications.

3. Liquidity

Liquidity represents the ability to be able to convert something into cash quickly. Real estate is less liquid as opposed to an ETF that can be bought on an exchange and sold quickly. If you compare this to a piece of property, it could take weeks, months or even years to sell.

However, not all ETFs carry the same liquidity, which could be tied to volume. Volume represents the number of shares that are traded for a security, such as an ETF.

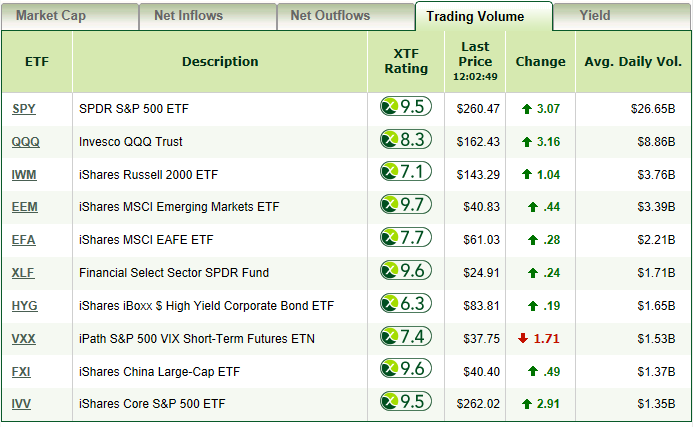

For example, the chart below shows the average daily volume of ETFs that have seen a lot of recent trading activity. These ETFs with a high degree of volume have a higher chance of being sold quicker than ETFs that have low volume.

In essence, volume can also be looked at as the demand for an ETF. Without demand for a specific product, it will be difficult to sell in the open market.

In essence, volume can also be looked at as the demand for an ETF. Without demand for a specific product, it will be difficult to sell in the open market.

For more educational information on ETFs, click here for Education Central.