![]() By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

While equity markets are not synchronized to a calendar, historically the U.S. equity market has suffered a price drop of 10% or more approximately every 18 months. It is important to note that market declines of this magnitude are not unusual and the stock market usually recovers quickly (see exhibit 1). As a result, despite significant intra-year declines, the S&P 500 Index has exhibited positive calendar year returns in 31 of the last 37 years since and including 1980, or more than 80% of the time.

The last sizeable equity market correction occurred 19 months ago in February of 2016. The lack of market volatility since then and the recent performance of some asset classes, such as emerging market stocks, downplays the risks associated with geopolitical uncertainties and other potential threats to market stability.

Despite the relatively calm market, we think that investors should be prepared for another market correction in the near-term. In our opinion, that readiness includes being primed to buy equities on a market decline. We think that investors should be prepared to increase equity market exposure on a sizable dip for the following three reasons.

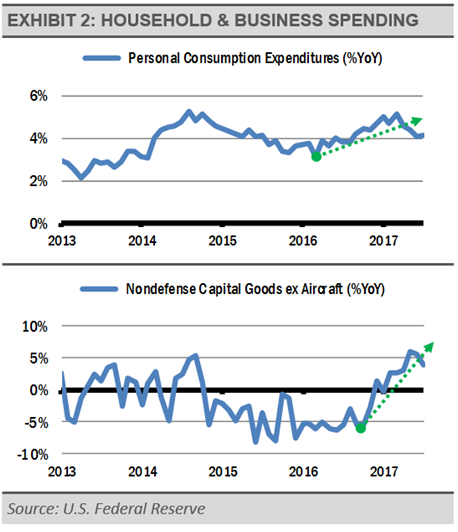

First, we think the U.S. economy is strong and can support corporate earnings growth and higher stock market prices. With labor markets continuing to improve, household spending should continue to drive economic expansion. In addition to consumer spending, we expect business investment to continue to grow.

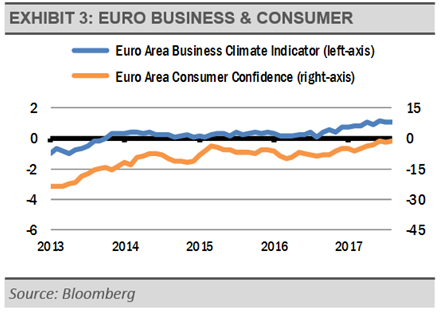

Secondly, and looking abroad, the euro zone economy is being boosted by strong business and consumer confidence, which can lead to further investment and hiring (exhibit 3). Strong consumer confidence can also lead to more personal spending. We think this region should continue to outperform consensus expectations, though we do not think that these are long-term trends. However, the current positive economic environment in Europe does create near-term opportunities.

Finally, global central banks continue to employ stimulative policies that should allow economic growth to continue. While the U.S. Federal Reserve is expected to follow its recent interest rate hikes with a slow reduction in the size of its balance sheet, both the European Central Bank (ECB) and the Bank of Japan (BOJ) continue to supply the global economy with additional stimulus through low interest rates and balance sheet expansion.