By Chris Konstantinos, CFA, Director of Investments, Chief Investment Strategist

SUMMARY

- We anticipate the US 10-year treasury yield will end the year meaningfully higher than current levels.

- We believe the Fed will hike another 75 basis points over the next few meetings.

- Investment opportunities exist in certain government, investment grade corporate and high-yield bonds, in our view.

A new calendar year has dawned…but the same controversies and questions that plagued the bond market last year are still with us. RiverFront’s Chief Investment Strategist, Chris Konstantinos, sat down with Global Fixed Income Chief Investment Officer (CIO), Kevin Nicholson, to discuss some of the most important questions facing income investors, as the bond market recalibrates after one of the worst years for bonds in modern history.

Some of the topics covered include: RiverFront’s forecasts for the Treasury market, the direction of inflation and Federal Reserve policy, the disconnect in behavior between government bonds and the corporate market, and of course, our favorite areas of investment. Here is a transcript of that interview, edited for clarity.

Chris Konstantinos: Ok, Kevin…I’ll start with a ‘softball’ question: What is your team’s projection for where the US 10-year treasury ends 2023? And what do you think the ‘terminal’ rate will be for this interest rate cycle?

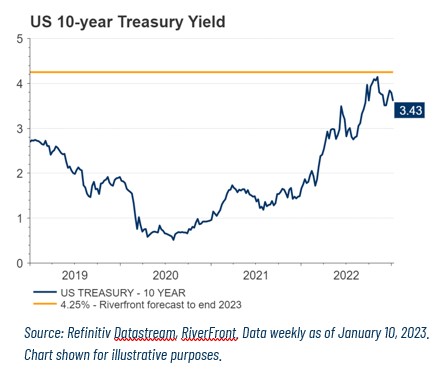

Kevin Nicholson: Our investment thesis going into the new year is that the Fed will raise the terminal fed funds target range to between 5.00-5.25%. Treasuries with maturities of 2 years and shorter should then move up to reflect the higher Fed funds rate. In this scenario we anticipate a 10-year Treasury rate of at least 4.25% by the end of the year, meaningfully higher than where we are today (see chart).

We arrive at 4.25% by studying history. In the late 70s and early 80s the yield curve ‘inverted’ by 80 basis points (bps) (meaning short maturity bonds yielded 80 bps more than longer maturity bonds), during a period where inflation was much higher than today. If we assume the worst and the yield differential between the 2-year Treasury and the 10-year Treasury returns to the levels of the late 70s and early 80s, this would imply a 10- year yielding around 4.20 – 4.45%.

Chris Konstantinos:

ON FED POLICY:

One of the hottest debates right now is the trajectory of inflation and Fed policy in 2023. What are you and Head Multi-Asset Portfolio Manager Tim Anderson predicting for the next couple of Fed meetings?

Kevin Nicholson: As the Fed ends its rate hiking campaign, predictions will get more difficult because they will become more data dependent. Currently we anticipate an additional 75 bps worth of hikes over the next 2 to 3 meetings. This also aligns with our terminal fed funds target range of 5.00 -5.25% due to the continued strength of the labor market. The Fed knows that it needs to cool the labor market to slow inflation and it is just not happening fast enough, based on the data.

Chris Konstantinos:

ON THE CURRENT DISCONNECT BETWEEN TREASURIES AND CORPORATE BONDS:

Kevin, you and I enjoy good-natured debate about whether stock or bond investors have the ‘superior’ read on macro fundamentals. But in reality, we equity folks admit many of the most useful tactical signals for stocks exist in the bond market.

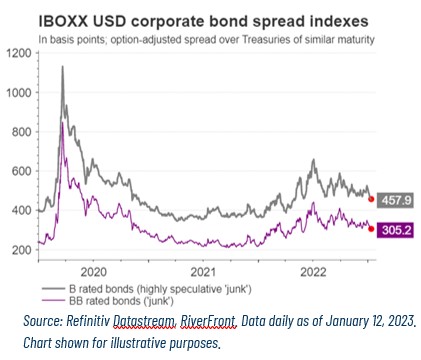

However, several of these signals are currently giving conflicting readings. For example, treasuries appear increasingly concerned about the economy, with yields recently compressing below 4%. This message seems incongruent with how corporate bonds are reacting, with the credit ‘spreads’ of risky debt such as ‘junk’ (sub-investment grade) compressing recently, indicating relative calm (see chart, below). How do you square that?

Kevin Nicholson: Chris, when is my ‘softball’ question coming? Every question that you have asked has been tricky! This one has been a conundrum, but we believe that the credit markets will be proven right due to the strength of the labor market. We believe that the Treasury market pricing in recession during the first half of 2023 is premature. You correctly pointed out that the stock and corporate bond markets are more aligned because they both are predicting that we will see continued growth in the first half of the year.

Chris Konstantinos:

OVERALL VIEW ON FIXED INCOME:

In our 2023 Outlook, your fixed income stance to start the year has been ‘Neutral’, but with a view towards increasing allocations tactically if the right conditions are reached, given the higher yields. What conditions are these?

Kevin Nicholson: Chris, there is a lot to unpack in that question! Using a tactical lens, we would be looking to move from cash to fixed income with the goal of out-yielding the Bloomberg Aggregate Bond Index (AGG). Entering this year, we believe that opportunities exist in Treasuries, investment grade corporate bonds, and high-yield.

Starting with Treasuries, we have a roughly 4% hurdle rate, meaning we will generally only look to add exposure to maturities that yield over 4%. Currently, that would limit our shopping list to two- and three-year maturity Treasuries. In investment grade corporate bonds and high-yield, the hurdle rates are closer to 5% and 9% respectively, as we wish to be compensated for taking credit risk at a time when many economists expect the economy to slow.

We continue to focus on shorter-maturity bonds in our shorter time horizon portfolios, due to our belief that the Fed will continue to raise interest rates. Short maturity Treasury yields are likely to react more to the change in rates and given their shorter maturities, the ‘breakevens’ (breakevens are the amount that yields can rise before the price depreciation of the bond is greater than the income generated by the bond; calculated on an annual basis) appear more attractive to us than longer Treasuries. In our longer horizon portfolios, we are willing to move further out on the yield curve to buy recession insurance. The longer a bond’s maturity, the more sensitive its value is to yield changes. Under a recession scenario, we think this will serve investors well.

Chris Konstantinos:

ON WHEN TO INCREASE DURATION:

In the Outlook, you have stated that your team prefers taking credit risk over interest rate risk. Given that view, it makes sense that the shorter-horizon portfolios are roughly a year under on duration (interest rate sensitivity) relative to the AGG. What will be some of the catalysts for you to consider increasing duration?

Kevin Nicholson: Now that the Fed is closer to the end of its rate hiking cycle than the beginning, I believe that we can begin to think about adding duration opportunistically to the shorter horizon portfolios. More specifically, I would say that the ideal time to be long duration relative to the AGG is when the Fed ends its’ rate hiking and pauses, because the next step will be lowering interest rates. That is the point when duration pays off as the economy potentially enters recession. Our investment thesis is calling for this moment to come in late 2023 or early 2024.

Chris Konstantinos:

BOND ASSET ALLOCATION:

As you look at the typical bond asset classes – which are your favorites for 2023? Which are your least favorites…and why?

Kevin Nicholson: If you do not mind, I am going to give you a nuanced answer. When we look at fixed income sectors, we view them through two distinct lenses: traditional benchmark sectors and non-benchmark sectors. Within the traditional benchmark sectors, we favor Treasuries and corporate bonds. We like Treasuries because they provide a risk-free return near or above 4%, which is a big improvement from a year ago. We like investment grade corporates because we believe most companies in this space refinanced their debt at the onset of the pandemic at lower rates, which lowers default risk for the foreseeable future for those companies. We believe that a strong labor market in the US will continue to support consumer spending and, in turn, generate adequate revenue for consumer-sensitive companies to meet debt obligations.

Moving on to the non-benchmark sectors, we prefer high-yield and bank loans because they provide a means to enhance a portfolio’s yield without taking too much duration risk. In the case of bank loans, the coupons ‘float’ (meaning the coupon adjusts as interest rates change) on a quarterly basis, which is helpful in a rising interest rate environment. Selectivity and vigilance are important since bank loans and high-yield will be among the first sectors to feel the impact of a recession given that these companies have more leveraged balance sheets. However, like investment grade companies, they too refinanced their debt at the onset of the pandemic.

One sector that we would avoid here is preferred stocks. These securities are typically callable, which means they may be redeemed by the issuer at a set value before the maturity date. This suggests to us that upside price appreciation is capped at or slightly above the call price. Additionally, they are also subordinated, which means they can technically depreciate to zero during tough economic times.

Chris Konstantinos:

ON BEING A TACTICAL ASSET MANAGER IN TODAY’S ENVIRONMENT:

You are considered RiverFront’s foremost expert on ‘tactical’ asset allocation. 2022 was a difficult year for tactical shifts in general given the extreme volatility in both stocks and bonds, and the ‘whipsaw’ risks that creates for managers. What cues do you take from last year’ s experience to inform what we may expect this year?

Kevin Nicholson: Like always we will adhere to our three tactical rules of “Don’t Fight the Fed”, Don’t Fight the Trend”, and “Beware the Crowd at Extremes”. However, in 2022 we viewed the three rules as a ‘combo deal’ and in 2023 may need to pay more attention to the ‘Crowd at Extremes’ in isolation. This is because the 3-rules did a good job signaling to de-risk the portfolios last year but fell short when it came to spotting the countertrend rallies. Therefore, we think that it may be important to isolate the ‘Crowd’ more to better take advantage of those countertrend rallies. Tactical is the hardest part of investing for me and I have many scars to prove it, but I think the most important aspect is to learn from your mistakes and work towards continual improvement.

Chris Konstantinos: Thanks, Kevin. As always, this has been a fascinating glimpse into the mind of a bond market veteran!

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

High-yield securities (including junk bonds) are subject to greater risk of loss of principal and interest, including default risk, than higher-rated securities.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa). This effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U.S. investments, and can decline significantly in response to adverse issuer, political, regulatory, market, and economic risks. Any fixed-income security sold or redeemed prior to maturity may be subject to loss.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

An option is a contract sold by one party to another that gives the buyer the right, but not the obligation, to buy (call) or sell (put) a stock at an agreed upon price within a certain period or on a specific date. A covered call option involves holding a long position in a particular asset, in this case U.S. common equities, and writing a call option on that same asset with the goal of realizing additional income from the option premium. Certain ETFs use a covered call strategy. By selling covered call options, the fund limits its opportunity to profit from an increase in the price of the underlying index above the exercise price, but continues to bear the risk of a decline in the index. A liquid market may not exist for options held by the fund. While the fund receives premiums for writing the call options, the price it realizes from the exercise of an option could be substantially below the indices current market price.

Index Definitions:

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

The Bloomberg Aggregate Bond Index or “the Agg” is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.

The Markit iBoxx USD Liquid High Yield Indices consist of liquid USD high yield bonds, selected to provide a balanced representation of the USD high yield corporate bond universe. The indices are an integral part of the global Markit iBoxx index families, which provide the marketplace with accurate and objective indices by which to assess the performance of bond markets and investments.

Definitions:

A basis point is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security. (bps = 1/100th of 1%).

A senior bank loan is a debt financing obligation issued to a company by a bank or similar financial institution and then repackaged and sold to investors. The repackaged debt obligation consists of multiple loans. Senior bank loans hold legal claim to the borrower’s assets above all other debt obligations. Most senior loans are made to corporations with below investment-grade credit ratings and are subject to significant credit, valuation and liquidity risk.

Treasuries: government debt securities issued by the US Government. Treasury securities typically pay less interest than other securities in exchange for lower default or credit risk. With relatively low yields, income produced by Treasuries may be lower than the rate of inflation.

Interest rate sensitivity is a measure of how much the price of a fixed-income asset will fluctuate as a result of changes in the interest rate environment. Securities that are more sensitive have greater price fluctuations than those with less sensitivity. This type of sensitivity must be taken into account when selecting a bond or other fixed-income instrument the investor may sell in the secondary market. Interest rate sensitivity affects buying as well as selling.

Don’t Fight the Fed – ‘Supportive’ means the Fed’s monetary policy regarding inflation and employment is in what we believe based on our analysis to be the investors’ best interest; ‘Against’ means the Fed’s monetary policy, in our view, is going against the investors’ best interest; ‘Neutral’ means the Fed’s monetary policy is neither supportive or against the investors’ best interest in our view. Don’t Fight the Trend – Terms correlate to the 200-day moving average as it relates to the equity indexes: ‘Positive’ means that the trend is rising, ‘Flat’ means the trend is flat, ‘Negative’ means the trend is falling. Beware the Crowd at Extremes – Terms correlate to the NDR Crowd Sentiment Poll and its measurement of Extreme Optimism (Bearish), Neutral, or Extreme Pessimism (Bullish).

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at riverfrontig.com and the Form ADV, Part 2A. Copyright ©2023 RiverFront Investment Group. All Rights Reserved. ID 2682156