By Kevin Nicholson, CFA, Global Fixed Income CIO, co-Head of Investment Committee

SUMMARY

- A hawkish Fed increases the probability of recession, in our view.

- We believe the trend will likely continue to decelerate as financial conditions tighten.

- Crowd Sentiment in extreme pessimism is a potential positive contrarian signal, in our view.

After eight months of economic uncertainty, we are entering the time of year that will determine how the race for investment performance will cross the finish line on December 31, 2022. Financial markets are anxiously awaiting the Federal Open Market Committee (FOMC) meeting on September 21st to see if the fed funds target range will be increased by 50 or 75 basis points (a basis point is 1/100 of a percent). Our three tactical rules of “Don’t Fight the Fed”, “Don’t Fight the Trend”, and “Beware of the Crowd at Extremes” are not designed to predict the size of rate hikes. Instead, they forecast the probability of having positive returns over a 3-month time horizon. At present, our ‘tactical rules’ are collectively waving the caution flag as the prospects of a positive return are below the long-term average over the next three months, in our opinion.

Source: Refinitiv Datastream, RiverFront. Data weekly as of 9.7.22. Chart shown for illustrative purposes.

Don’t Fight the Fed: More Hikes to Come

The Federal Reserve (Fed) is set to meet later this month to adjust its fed funds target range to tame inflation. The fed funds target range is presently set at 2.25% to 2.50%, and the futures market is predicting an 86% probability of a 0.75% increase at the meeting. Regardless of the Fed’s chosen increase, this will be the fifth meeting in a row that rates will increase. Federal Reserve Chairman, Jerome Powell, made it undoubtably clear to financial markets at the August 6th, Jackson Hole Symposium that the Fed would not pause, and that more hikes were to come. Given the Fed’s determination to defeat inflation, we are now expecting hikes of 50 and 25 bps at its November and December meetings, respectively. Thus, we believe that the fed funds target rate will end the year between 3.75% to 4.00%.

While the Fed has been using rate hikes as its predominant tool to attempt to tighten financial conditions, its balance sheet reduction is only now beginning to take shape. After not meeting the monthly balance sheet reduction target of $47.5 billion in July and August, the Fed is scheduled to increase the monthly target to $95 billion in September, consisting of $60 billion of Treasuries and $35 billion of mortgages. The slow start by the Fed has mostly been attributed to rising interest rates that effectively killed the mortgage refinancing market, which eliminated prepayments and resulted in previously anticipated mortgage maturities extending. Since the beginning of July, Treasuries on the balance sheet have been reduced by $73.1 billion, while mortgages were virtually unchanged, down $37 million. Given the Fed’s determination to get inflation under control, we believe that it may have to sell mortgages to reduce the balance sheet rather than just let them mature as previously intended.

Source: Refinitiv Datastream, RiverFront. Data weekly as of 9.12.22. Chart shown for illustrative purposes. Past performance is no guarantee of future results. Not indicative of RiverFront portfolio performance.

Currently, the Fed’s aggressive attempt to squash inflation has taken the prospect of a soft landing off the table, in our opinion. We no longer believe that the Fed will be able to insulate employment and the economy from being negatively impacted while raising rates. However, we expect any recession, when it occurs, to be less severe given the relative health of the US consumer and corporate balance sheets. Additionally, we expect nominal GDP to remain positive even in a recession scenario, thus cushioning the economy from a hard landing, but not enough to get a soft landing.

Source: Refinitiv Datastream, RiverFront. Data weekly as of 9.12.22. Chart shown for illustrative purposes. Past performance is no guarantee of future results. Not indicative of RiverFront portfolio performance.

Internationally, the Bank of England and the European Central Bank are following in the Fed’s footsteps of Quantitative Tightening (QT) by raising interest rates and starting to shrink balance sheets (see chart, below), while the Bank of Japan has chosen to maintain Quantitative Easing (QE) by keeping its ten-year yield anchored near zero, using yield curve control.

However, with three out of the four most influential central banks in the developed world engaging in QT, we believe that central banks are not on the investor’s side.

Don’t Fight the Trend: Not the Investor’s Friend

The trend of the S&P 500 is currently falling at an annualized rate of 15%. With the index currently trading around 4100, (see chart below) the trend will not turn positive prior to year-end unless there is a massive rally that takes the S&P back up to approximately 4500 in the coming weeks. Given the recent shift in market expectations regarding the Fed ‘s commitment to hiking interest rates, such a rally is unlikely in our opinion. The S&P 500 is approximately 27% technology, a sector whose valuations are particularly sensitive to rising interest rates. Therefore, we believe the trend will continue to decelerate in the technology-heavy S&P 500 due to efforts to raise rates and tighten financial conditions. We currently see the S&P 500 trading in a decision box of 3900 to 4300, with secondary support at 3750 if the bottom of the box is breached.

Internationally, the trend of the All-Country World Index ex-US (ACWX) is currently falling at an annualized rate of 25% and, disappointingly, has reversed essentially all its 2020-2021 rally and then some (see chart, below). Much like the trend in the US, the ACWX trend has limited prospects of reversing its downtrend due to the headwinds facing developed international markets. The economies of the UK and Eurozone for instance are facing accelerating inflation that is being exacerbated by rising energy prices due to the Ukrainian and Russian war. Both fundamentally and technically, international stocks look more vulnerable than the US, in our view.

Overall, the trends of global stock indices are showing signs of fatigue and are no longer the investor’s friend, in our view. Historically, when the trend is positive for domestic or international stock markets, the probability of investors experiencing positive returns rises; unfortunately, that is not the scenario we currently face. Thus, we believe that our “Don’t Fight the Trend” rule is indicating to precede with “caution”, because the trend is not the investor’s friend.

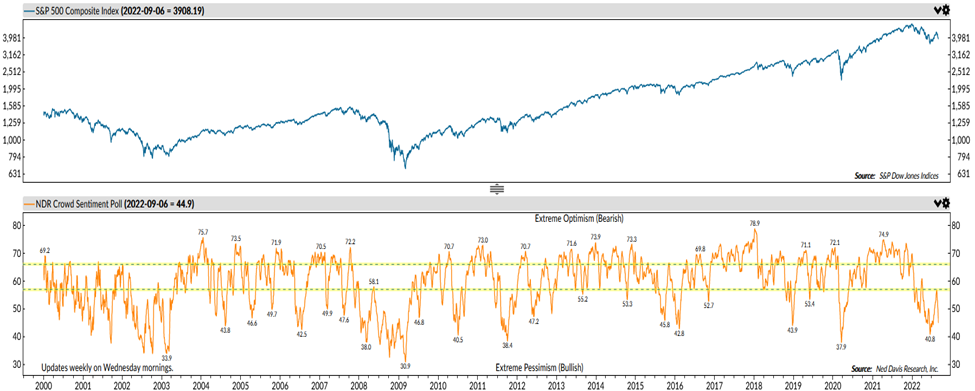

Beware of the Crowd at Extremes: Sending a Contrarian Bullish Signal

Out of the three tactical rules “Beware of the Crowd at Extremes” is the only rule that we consider to be a contrarian indicator. Currently, the Ned Davis Weekly Crowd Sentiment Poll is at extreme pessimism and has been in this zone for most of the summer, as shown in the chart below. While the crowd is not as pessimistic as in previous periods, it is languishing in the pessimistic zone due to the S&P 500 not being able to make a meaningful retracement back up to its January high of 4818, in our opinion.

There has been a tremendous amount of economic data that led investors to become more pessimistic, but just like an auto race, the time comes when you must move forward after much caution. Given the contrarian nature of the Crowd, and if history is a guide, we believe now is the time to start thinking about adding stocks to the portfolio opportunistically as the indicator becomes more pessimistic. Therefore, we believe that the Crowd is giving a contrarian bullish signal to restart adding riskier assets to portfolios.

Source: Ned Davis Research (chart S574A) © Copyright 2022 Ned Davis Research, Inc. Further distribution prohibited without prior permission

Conclusion:

Two out of three of the tactical rules – “Don’t Fight the Fed” and “Don’t Fight the Trend” – indicate that we should remain cautious, while “Beware of the Crowd at Extremes” would advocate for adding stocks. However, we are very familiar with the nuance of parsing conflicting signals from our rules, and thus our process does not call for an all-or-nothing approach. Since we know that our tactical moves will not always be correct, we tend to move incrementally and allow our risk management discipline to course correct, if necessary.

Currently, our shorter horizon portfolios, which tend to be more risk-adverse, maintain a slightly underweight positioning to equities, while our longer horizon, more risk-tolerant portfolios are roughly neutral. We have chosen to take this stance so that we can better react to changing market conditions.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Index Definitions:

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

MSCI ACWI ex USA Index captures large and mid cap representation across approximately 22 of 23 developed markets (DM) countries (excluding the US) and approximately 25 emerging markets (EM) countries.

In a rising interest rate environment, the value of fixed-income securities generally declines.

A basis point is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security. (bps = 1/100th of 1%)

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

The federal funds rate is the target interest rate set by the Federal Open Market Committee (FOMC). This is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios.

Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability.

Quantitative easing (QE) is a form of unconventional monetary policy in which a central bank purchases longer-term securities from the open market in order to increase the money supply and encourage lending and investment.

Quantitative tightening (QT) refers to monetary policies that contract, or reduce, the Federal Reserve System (Fed) balance sheet.

Don’t Fight the Fed – ‘Supportive’ means the Fed’s monetary policy regarding inflation and employment is in what we believe based on our analysis to be the investors’ best interest; ‘Against’ means the Fed’s monetary policy, in our view, is going against the investors’ best interest; ‘Neutral’ means the Fed’s monetary policy is neither supportive nor against the investors’ best interest in our view. Don’t Fight the Trend – Terms correlate to the 200-day moving average as it relates to the equity indexes: ‘Positive’ means that the trend is rising, ‘Flat’ means the trend is flat, ‘Negative’ means the trend is falling. Beware the Crowd at Extremes – Terms correlate to the NDR Crowd Sentiment Poll and its measurement of Extreme Optimism (Bearish), Neutral, or Extreme Pessimism (Bullish).

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2022 RiverFront Investment Group. All Rights Reserved. ID 2420016