Well, it’s labor day weekend, so I was going to write about labor. But as soon as I started thinking about labor, I started thinking about value, and, well, Ethereum-based smart contracts with a URL pointing to a rock — that’s all NFTs are — are trading for millions of dollars, leaving most advisors scratching their heads and figuring out how to get off the grid and source local food.

I wrote quite a bit about NFTs in a more “what the heck are they” vein back in March, so if this is all complete gobbledygook, perhaps start with “How to talk to your clients about NFTs.” But moving on:

How do we think about the value of something that lacks really clear utility? That’s really the essence of the NFT debate. And without getting too deep into the Buddhist concepts of Suchness or scientific research on why we value certain objects, I’ll start from the premise that “things are as we decide them to be.” A chair is only a chair to a human being. To an alien, it’s a piece of wood. That we all agree a chair is a chair is a combination of actual utility (you can sit on it) and a collection of features we societally agree make “chairness” unique from “place to sitness” (Seats, backs, legs). So here’s this “thing”:

An Ether Rock

— an NFT — which has no actual utility (I cannot sit on it), but might have some societally agreed on non-utile value. So how do we assess the boundaries of this if we’re actually in the business of growing Value — it’s philosophical sense — for our clients?

NFT-as-Art: Public Display & Derivative Works

“NFTs are Art man … People value art!”

Fraction of Beeple’s “Everydays”

The core argument here is that NFTs are just another kind of collectible that lacks the physical component of a baseball card or a Picasso. This is pretty obvious, since many of the early NFTs were artworks like Beeple’s (an artist I quite like) and Grimes (I dug Art Angels). And sure, I can understand this, but even if we make the 1-1 connection between Art and NFT, there are still some pretty big holes in this argument that need to be patched.

Owning a piece of artwork does not automatically give you universal rights to display it publicly or do anything else with it. If the art you own is now in the public domain — a Picasso for instance — it’s like anything else in the public domain: make a print, put it in your yard, charge people to come see it if you can. Make a Picasso your home page or your twitter icon. People track every year what great art is aging into public domain just for those reasons.

This isn’t the case when the copyright is still active — usually because the person is alive — and as far as I can tell this would cover pretty much every NFT in existence. Since copyright quite clearly doesn’t go anywhere when you buy the NFT (and as far as I’ve been able to discern, you have zero legal rights if the NFT issuer just issues more NFTs featuring the same pointer to the same artwork) what you can actually DO with an NFT is quite limited.

One thing I’m pretty sure you can’t do is buy a bunch of NFTs and then put them on display in your corporate lobby. I get that people are already doing this. There are lots of blogs about all the cool ways to display your NFT, but by my read, these are all technically illegal. Unless you, as a legal actor, were assigned copyright by the copyright owner explicitly (which, to my knowledge, no NFTs of any note do), then public display is explicitly something only allowed by the copyright holder.

I am not a lawyer, this is not my original idea, and I have no skin in the game on either side, and there are a lot of articles covering this from Copyright lawyers since the spring, because lawyers love money, and there are a whole lotta new things to charge for here. I’m just pointing out this use case for NFTs as art has huge problems if it’s going to be real in a meaningful, legal way. And if it’s not real in any meaningful, legal way, than a whole lotta theft, copying and fraud is going to start chasing these large dollars with zero recourse — because you can’t sue someone for violating rights you never had. I could change my avatar to the most expensive NFT, take out a billboard declaring my ownership of it, and reproduce it all over the internet, and the only person who would have a claim on me would be the guy who did the art in the first place, not the NFT holder.

And if you chase that through, it means you technically don’t even have the right to use your CryptoPunk as your twitter avatar. I get that this has become a universal, global expectation. The irony is if you actually read the entirety of the CryptoPunk contract and related docs (which, yes, I have), the only thing the issuer asserts copyright on is the software text of the contract itself. The individual tokens? Nada.

So NFT as Art? Yes, but with all the rather draconian restrictions any other piece of artwork you buy has.

NFT as MetaVerse Swag

“NFTs are objects for the Metaverse man!”

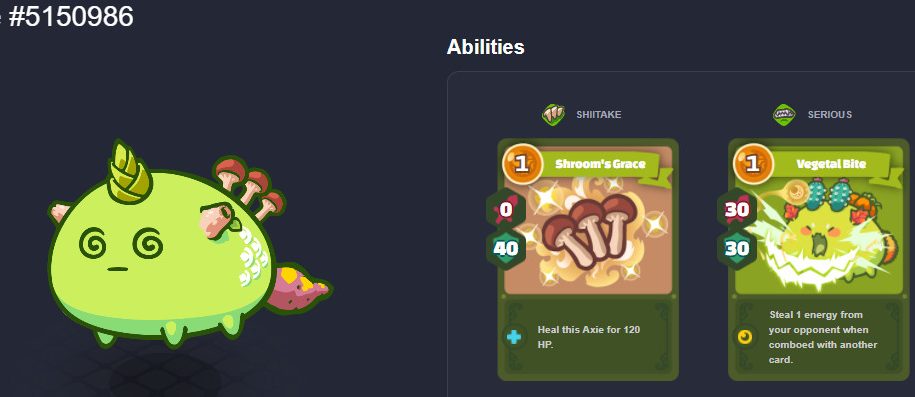

An Axie

While you may not legally be able to display your NFT publicly or make any derivative works from it, the second argument about why NFTs are cool is that, when we think of the purely digital set of interactions and assets we as humans participate in (sadly, being called ‘the MetaVerse’ which conjures up unnecessarily science fiction/ReadyPlayerOne type images), you still have a unique, identifiable, probably unhackable digital object which is easy to verify and transfer. That’s cool!

The issue I have around the various metaverse descriptions is that most of them devolve into some expression of Virtual Reality. I get it, I’m a VR and virtual world nut (go get a Quest 2, it’s baller), from World of Warcraft to Minecraft to Second Life to Valheim. The interaction between real-money and virtual-objects is really well understood territory — it’s the basis for countless Video Games from Eve Online (where real money impacts abound) to the World of Warcraft gold mines. So while I really dig virtual worlds, and I really dig games, and I really dig weird economic models, I think the inversion here — the asset coming before the world so to speak — is a bit off kilter (or, I suppose, super exciting if you believe in some unknowable end-state!)

That doesn’t mean NFTs aren’t going to radically transform digital worlds — they absolutely will and are already starting to — the Axie above is a character you can buy and sell but also use in a very real game world. But ultimately it will be the entertainment value (or other utility) of those virtual worlds which will determine how much time people want to spend in them. The Free-to-Play game developers figured this out a long time ago, honed it on Kim Kardashian, and are now booking literal billions of cold hard dollars manipulating the value of in-world scarcity and swag. Everything the NFT folks have figured out about rarity tables and whale-buyers is Econ 101 for anyone in that industry, and I suspect the big-budget world builders are the ultimate winners here.

NFT as Social (Identity) Token

“NFT’s are Social Tokens man! You’re part of a club of like-minded crypto folks!”

The next idea I keep seeing floated around is that somehow we’ll use the ownership of, say, a CryptoPunk, as our membership card to a club of fellow CryptoPunk owners, and an ecosystem will develop in which that’s really awesome.

I have several reasons why I, personally, am deeply uninterested in this.

- As it stands, the ONLY thing you need to join ANY “NFT Club” is capital. While there are all sorts of very cool things one can do because of that, I find it a deeply uncompelling social reason to care about NFTs. I have zero interest in joining any club where “being rich and wanting to” are the only criteria for membership.

- Send the hate mail, but I believe most meaningful social interactions require identity. That identity can absolutely be pseudonymous — I know dozens of writers people would be surprised to learn don’t use their legal names in their work to avoid harassment. But identity is built up from the actions of the individual in a way that accrues to some form of individuation. If I buy a CryptoPunk to use as an avatar I am EXPLICITLY abandoning the anonymity which is one of the big features of both NFTs and Crypto in general. I am asking the world to connect “Dave Nadig” with “Punk 1234” or whatever.

It’s not that you couldn’t make a fun club. Heck, the guys at Bored Ape Yacht Club literally put “Club” in the name, and unlike most NFTs, they at least claim on their website that holders have commercial rights to their tokens (the actual contract has no language whatsoever about this, so good luck trying to “prove” that if something goes hinky!).

A Bored Ape

To me the big missing piece of the “social token” version of NFT value remains identity. Social networks aren’t built just on cash, they’re built on mutual interests, shared intelligence, common goals and desires, belief systems and values. Great users of social leverage (say, Howard Lindzon) don’t just have big bankrolls, they have charisma and communicate well, and more often than not, have shown themselves to be decent people as interested in their fellow humans as humans as they are in themselves. Howard can buy an NFT and prove it’s his today – just like proving who you are with a picture for a Reddit AMA. But you have no way of knowing if that token is still under his control the next time a piece of software reads the token. Solvable? Sure, and plenty of folks working on it. But also counter to a lot of the Crypto-ethos.

NFT as Ecosystem Anchor

“NFT’s are the base-block of a whole new digital asset ecosystem man!”

By far the most interesting NFT project I’ve seen this year is Loot (Great overview here). Loot started as a goofy idea (by the original guy behind Vine) to just mint literal lists of items on black backgrounds for a text adventure he was working on (yes, like Zork). He randomly generated 8,000 lists and then let people just pay the gas fees to mint them. He made nothing, really.

A Loot Token

But then people took these Loot tokens and started building other tokens, websites, systems and so on that required you to have a loot token. In some cases, you could use your list-of-items to mint a pretty looking bag or even a faux-D&D character who might, say, need that Necklace of Enlightenment (Lord knows I do).

Again, this is incredibly cool as an experiment in generative storytelling and worldbuilding. And I am down for those kinds of experiments. I love immersive theater environments like Then She Fell where participants feel like collaborators. I love hippy role playing games like Fiasco where you’re building a whole world together. And I think Loot’s incredibly exciting as an experiment.

But, right now, because the ecosystem is built of 8,000 tokens has a floor price (the cheapest NFT in the set) of $30,000, it’s hardly going to be “mainstream.” It’s going to be an experiment amongst crypto natives with trapped value in crypto. (and yes, I know there are solutions to this that involve “renting” the NFT from someone to go do a thing. That’s how Axie works, but to my tastes it just embeds a kind of perverse, exchange-seat capitalism into something that’s supposed to be a game).

Conclusions? Trapped Value, The Money Multiplier & Procyclicality

If all of that makes you think I’m super negative on NFTs, I’m not. I’m actually pretty excited for almost everything I read, every day, in the crypto ecosystem. But I do have concerns that because the way Crypto has developed is deeply financial in nature (as opposed to, say, designed for a social or artistic purpose inherently) we’re going in odd directions.

In the real economy, value naturally expands through work, and money naturally expands through banking. If I’m a farmer and I take my labor to grow carrots, and you buy my carrots for a dollar. I have a dollar and you have a socially agreed upon dollar’s worth of carrots. If you now sell those carrots again for, say, $2, because you did the work of driving to my farm, then I have a dollar, you have 2 dollars, and someone has a socially agreed upon $2 of carrots. Quick, how much money is in the system? No new dollars were printed, but the system has $5 in value, where before it had $3.

This is precisely what’s happening in the Crypto ecosystem. I buy $1 worth of ETH. I then buy an NFT for a dollar. I have an NFT worth $1 dollar based on social convention, you own $1 worth of ETH, but when we read about “value trapped” in the ecosystem, $2 is what will get registered, even though only one dollar entered the system. And the person who sold me that original ETH has my original dollar … they might have turned around and bought something else in the ecosystem, but the dollar I put in isn’t destroyed — its exchanged for something I believe has the same value. As long as value is being created somewhere, the system works fine. If there’s no actual socially agreed upon value, however, it’s just a game of “last one out’s a rotten egg.”

This is the subject of the shortest paper ever published on SSRN on “Bubble Wealth,” and honestly, I’ll be shocked if it’s at all controversial, even though it seems surprising to a lot of folks I talk to about NFTs. It’s baked into everything from the barter system to the fractional reserve banking system.

Note: This value transfer and expansion is is quite different than this experiment where twitter user @RealNatashaChe bought and then destroyed a diamond in order to make the point that the value storage of the diamond could transfer into an NFT.

Destroyed Diamond

In that case the initial object, the diamond, is gone. The dollars are in the hands of the diamond dealer, and she’s trying to get someone to give her that much money for the JPG of the diamond. (The auction closes in a week, but at the current bid, she’s succeeded.) In that case, value has actually been destroyed — a thing there’s pretty broad agreement on the value of literally no longer exists. So if someone gives her ETH, and she then cashes that out, then she has *extracted* that much value from the ecosystem, so she gets a pass on the whole “money multiplier” thing.

Put another way — because of the rapidly expanding nature of both NFTs and DeFi, all of which rely on similar entry points to the ecosystem (ETH, SOL, BTC, a few others), than by definition, we have a hugely procyclical function to deal with. If, say, some exogenous event made the next few trades of ETH price at half their current price of $3,800, that would imply the “trapped” value dropping from $450B to $225B, even though not a single U.S. dollar has changed hands. That would also make the value of all the Cryptopunks every minted drop from $1.2B to $600 million, without a trade happening in Cryptopunks. Given the importance of leverage, staking and momentum in crypto trading, a handful of trades can cannonball quite quickly.

It works, of course, exactly the same in the opposite direction. Any fun and exciting new project attracts folks who will trade their ETH (or whatever is already in-system) for NewNFT or NewCoin, and at the point of issuance, we’ve doubled the value trapped in the system long before any true social or real-economy value has actually been created — there are no carrots on minting. Wash, rinse, repeat. It’s just Fear vs. FOMO. All that means is that we need to see these giant numbers for the ecosystem with clear eyes: they are implied psychological commodity values, not utility values (mostly).

My Point (And I Do Have One)

I’m actually super bullish non Crypto and NFTs and particularly, the kind of tokenized asset management being done in the DeFi space, which you’ll hear lots more from me about over the coming months.

But at the same time, I talk to advisors and high net worth folks and teenagers nearly every day who are completely enthralled by what’s going on here. There’s an enormous sense that “this is the internet!” and people don’t want to miss it. And people are throwing large arounds of fungible digital assets — ETH or BTC they could turn into dollars — at seemingly random and worthless collections of ones and zeros. It’s innovators trading against themselves, essentially, each actor hoping, believing or trying to build the thing that ultimately lasts and has long term value to the global economy. To people. It’s exciting. It’s cool.

But here’s the thing: it’s also OK to miss it. I believe the Crypto sandbox is going to revolutionize how we move value around the global economy in countless ways, the same way the internet revolutionized how we move information around the global brain. But big, big global change happens much more slowly then technology itself. in the mid 1990s when I bought “Nadig.com” I paid way too much money to register it, because it was obvious to me it was real estate. It was a corner of something explosive that I could own for the cost of a good dinner every year (now, the cost of a cup of good coffee). But domain names only really work in their modern application because ICANN was formed in 1998 to figure it all out and standardize things.

Right now, there’s no ICANN for Crypto, and I’m not suggesting someone has to be the central authority or we need to regulate everything to the hilt. What I am saying is that it’s OK to let an ecosystem evolve. Advisors didn’t buy ETFs in 1993 when they launched. It took a decade of refinement and institutionalization for them to become mainstream. While it may not take a decade this time around, I don’t think anyone’s going to lose their shirt simply staying informed and watching the show for a bit. Wanna toss some money around just to have skin in the game? Awesome. It’s the best way to learn. Just be careful out there.