High-quality companies—companies with strong profitability metrics, low debt and low variability in earnings—represent one of the better opportunities in the market today.

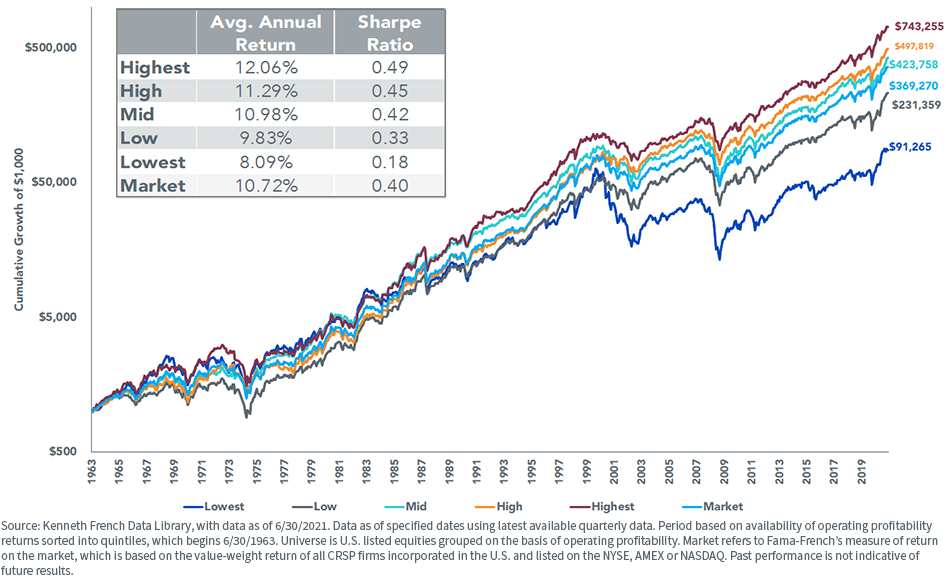

Academic research shows that a very simple sort of the market by a profitability metric known as return on equity (ROE) has delivered strong long-term returns. The return spread between the highest and lowest ROE companies has been approximately 4% a year going back almost 60 years.

Looking over more recent history, we see over the last 15 years that high-ROE stocks have even expanded their lead over low and negative ROE stocks. But over the last year, there has been a large “junk rally” taking place, with the market propelled by firms with negative ROE or the lowest ROE.

WisdomTree believes fundamentals are going to start to matter again as we get later into the bull market cycle and have a return to the longer-term trends of profitability and ROE driving performance.

WisdomTree launched a family of quality Indexes in 2013 that shifts the weight to high-ROE stocks—as well as stocks with low leverage and positive expected earnings growth trends. It manages valuations of this basket by incorporating a rebalancing process back to dividends and the underlying cash flows once a year.

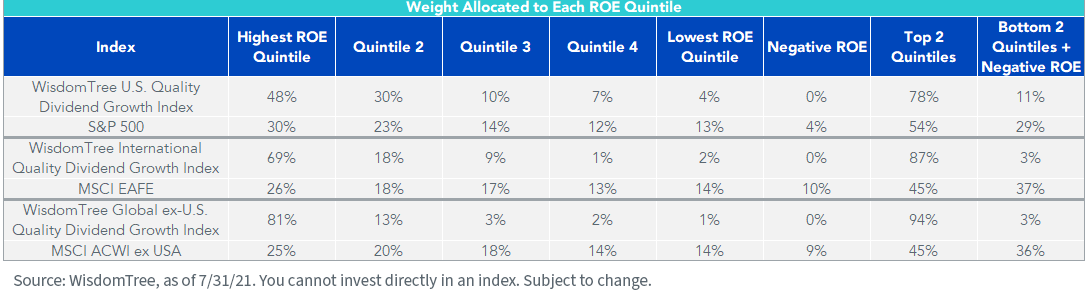

The following table shows the weight to the various ROE quintiles across the U.S., developed international and global ex-U.S. quality Indexes.

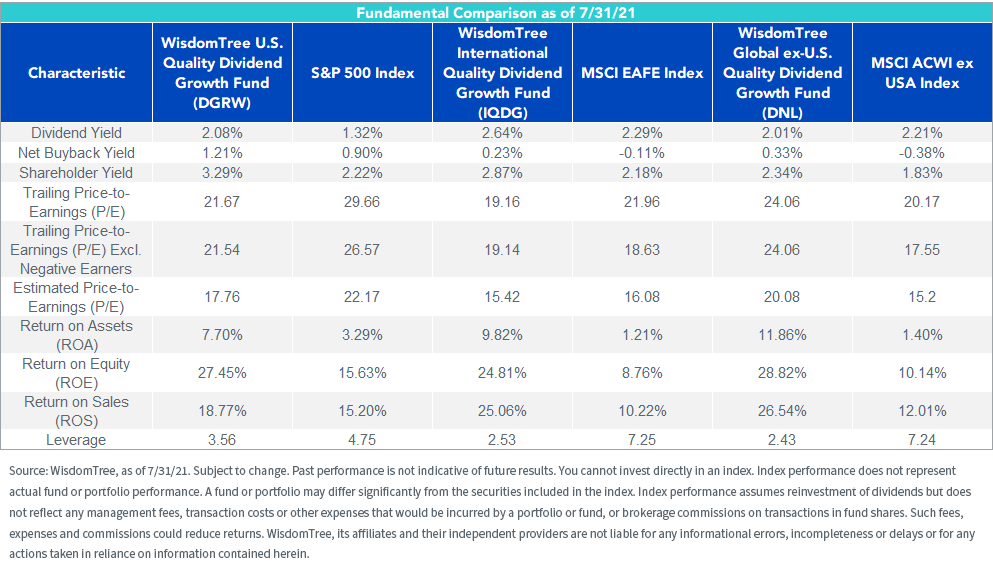

While the U.S. market sees more than 75% of its weight in the two highest ROE quintiles—a full 24 points higher than the S&P 500—the international versions of the strategy see 87% and 94% of their weight allocated to the top two quintiles, essentially doubling the weight of the international MSCI benchmarks. International stocks have a reputation of being cheaper than U.S. markets for good reason. That is because they tend to have lower profitability and lower growth prospects. The MSCI EAFE Index, for instance, has an ROE of just 8.8%, while the S&P 500 has 15.6% ROE.

International stocks have a reputation of being cheaper than U.S. markets for good reason. That is because they tend to have lower profitability and lower growth prospects. The MSCI EAFE Index, for instance, has an ROE of just 8.8%, while the S&P 500 has 15.6% ROE.

Yet when you employ a quality discipline in these foreign markets, you can get ROEs at significant premiums even to U.S. markets while retaining a valuation discount.  Overall, we believe that there is an opportunity in the current quality market that should not be overlooked. Markets may have dislocated from longer-term quality trends over the past year, but we think they’ll restore their preference for higher-quality companies soon.

Overall, we believe that there is an opportunity in the current quality market that should not be overlooked. Markets may have dislocated from longer-term quality trends over the past year, but we think they’ll restore their preference for higher-quality companies soon.

Originally published by WisdomTree, August 24, 2021.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.