By Kevin Flanagan, Head of Fixed Income Strategy

Is it too early to be considering Federal Reserve “exit strategy” protection for your fixed income portfolio? I’ve been focusing a lot on this topic of late, and for good reason.

Think about it. If I had asked you your thoughts on monetary policy a few short months ago, the more likely answer would have been: “Oh, nothing to worry about for the foreseeable future… Fed policy is on a ‘perma-hold’: i.e., no tapering, let alone rate hikes, will be forthcoming for quite a while.” You know what, I wouldn’t have necessarily disagreed with you either. BUT, as I’ve been blogging recently, there seem to be some “winds of change” in the air, and at a minimum, I feel investors should be contemplating some shifts in potential portfolio positioning now, so there are no “Fed surprises” lurking out there.

Please find standardized performance foir USFR by clicking here.

For definition of Indexes in the table, please click here.

While the timing of potential balance sheet tapering is certainly on my radar, it’s the pushed-up timing of the first rate hike that has gotten my attention. And as I mentioned in last week’s blog post, it would only take three Fed members to adjust their forecast for the median estimate to move to a 2022 timetable, putting portfolio positioning in a clearer focus.

One vehicle of choice that investors have chosen in the past (and present) as a solution to this backdrop is Treasury Inflation-Protected Securities, or TIPS. The TIPS arena can be broken down into two buckets, one being shorter dated (0–5 years) and the other more closely representing the entire TIPS market in general.

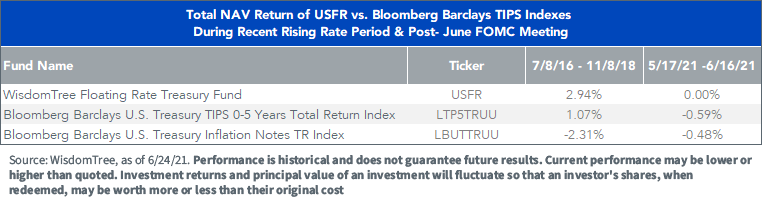

After closer review, one discovers that TIPS have been a less than optimal solution when the Fed is “on the move.” A better option would be to utilize a Treasury floating rate note (FRN) strategy. The chart above highlights how the WisdomTree Floating Rate Treasury Fund (USFR) and TIPS have fared in the most recent rising rate period of July 2016 through November 2018, as well as the market’s initial response to the just-completed June FOMC meeting. Clearly, USFR had the advantage when compared to both TIPS buckets in both instances.

Conclusion

Admittedly, the post-June FOMC meeting period was only about a month, but in my opinion, it provided a “real-time” example of how each of these rate-hedging solutions could perform when the Fed does finally begin its exit strategy. Remember, the Fed “only” talked about “talking about tapering” and pushed its timing for lift-off to 2023 from 2024. Ask yourself what could happen if/when the Fed outlines its taper outlook more succinctly AND potentially pushes up its first rate hike estimate to 2022 later this year. The next time the Fed will publish the “blue dots” is in September, less than three months from now. Against this backdrop, investors may want to start considering how USFR could fit into their fixed income portfolio for “Fed protection.”

Originally published by WisdomTree, 6/30/21

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value. The issuance of floating rate notes by the U.S. Treasury is new, and the amount of supply will be limited. Fixed income securities will normally decline in value as interest rates rise. The value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Treasury Inflation-Protected Securities, or TIPS, provide protection against inflation. The principal of a TIPS increases with inflation and decreases with deflation, as measured by the Consumer Price Index. When a TIPS matures, you are paid the adjusted principal or original principal, whichever is greater

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.