For yield-starved investors, ETFs holding real estate investment trusts (REITs) have historically been an attractive option for regular portfolio income. But one often overlooked type of REIT is offering particularly attractive yields: the mortgage REIT (mREIT).

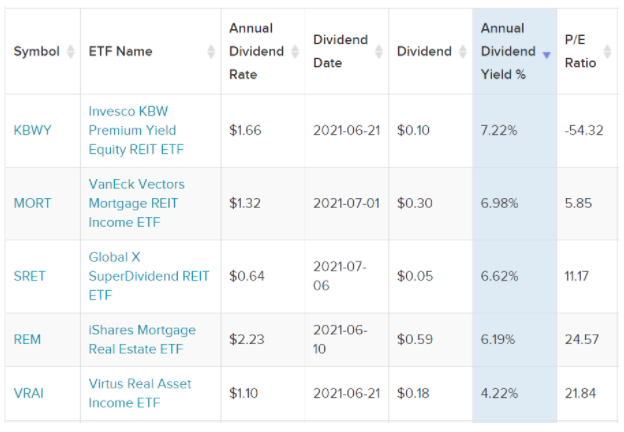

Two of the top five highest-yielding REIT ETFs are mortgage REITs. The VanEck Vectors Mortgage REIT Income ETF (MORT) and the iShares Mortgage Real Estate ETF (REM) are putting up annual dividend yields of 6.98% and 6.62% respectively.

Source: ETF Database

What Is a Mortgage REIT?

REITs are built to give away most (90%) of their earnings as dividends, making them ideal for investors who need a steady source of cash.

Whereas traditional REITs own real estate and earn their dividends through rent on their properties, mortgage REITs function more like banks in how they generate profit. They own mortgages and mortgage-backed securities, generating income through the spread of borrowing and lending.

This particular model can come with more interest rate risk than a traditional equity REIT, but they also have been out-yielding equity REITs.

About MORT and REM

MORT isn’t just a high-yielding fund: the ETF is up 71.62% over the last year, making it the best-performing REIT ETF of the past twelve months.

Its primary holding is Annaly Capital, which comprises 12.79% of its portfolio assets. Annaly has been gaining steam of late, and currently has a dividend yield north of 10%. The company’s quarterly earnings will be released later this month.

With 24 names, MORT has a somewhat concentrated portfolio, meaning that it might not seem as diverse as it is. However, because it holds REITs, each of those 24 companies actually has exposure to hundreds or even thousands of individual mortgages and securities.

Meanwhile, REM is up 71.09% over the past year, second only to MORT.

The two ETFs share many holdings in common, including Annaly Capital, but REM has slightly more holdings in its portfolio (currently 35 to MORT’s 25), spreading its exposure among small-, mid-, and large-cap companies.

For more news, information, and strategy, visit the Dividend Channel.