Despite the Covid-19 variant Delta circulating throughout major U.S. cities at a rapid pace, analysts still expect economic recovery to continue to expand through the rest of the year, according to the Wall Street Journal. But anything could happen—leaving some investors looking to hedge their exposure to tail risks using instruments such as the Simplify Nasdaq 100 PLUS Convexity ETF (QQC).

Delta’s impact on the economy is expected to remain limited, as health officials look to reduce restrictions and instead attempt to boost immunization numbers. As the variant spreads, with hospitalization rates and deaths increasing, heaviest impacts remain concentrated in areas that have low vaccination rates.

“The variant is a significant downside risk for the economy, but that risk is more than offset by what are still very strong fundamentals,” Oren Klachkin, lead U.S. economist at Oxford Economics, told the WSJ. “Consumers have a lot of cash and seem eager to spend on activities they couldn’t do for 18 months. And, for now, it seems like the vaccines should be able to keep the spike in cases fairly low.”

Forecasting firm Oxford projects that the U.S. GDP will rise at a 9% annualized pace in the third quarter.

As spending continues to increase and restrictions remain lifted, retail spending is anticipated to continue its growth. For example, retail sales were up 18% in June as compared to February 2020, just before the pandemic shuttered businesses across the country.

Convexity in Times of Growth

Investors eyeing the Delta variant may be wondering how best to profit from economic growth while still protecting their portfolios in case of sudden, unexpected shocks.

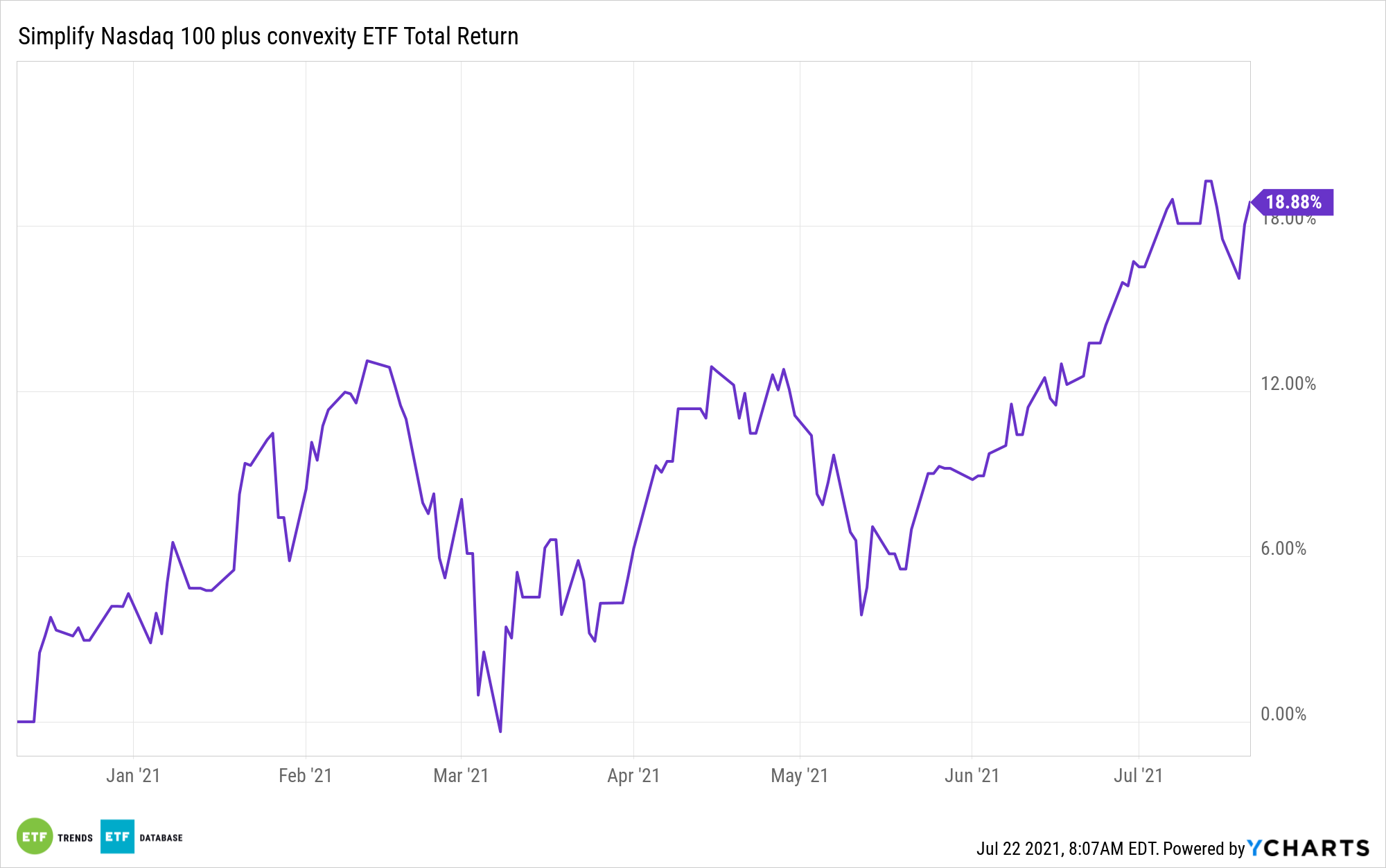

The Simplify Nasdaq 100 PLUS Convexity ETF (QQC) offers exposure to the U.S. growth equity market, but also boosts performance during extreme market moves up or down by utilizing a systematic options overlay.

The options portion of the ETF is used to harness “convexity,” protecting capital during drawdowns while capitalizing on rallies—meaning investors would be well-positioned regardless of whether the COVID-recovery economy stumbles or soars.

While 80% of the fund invests in ETFs invested in companies within the Nasdaq-100 Index and looks to maintain consistent exposure to the companies on the Index, it reserves the 20% for its options overlay.

The options overlay works by purchasing put and call options on the Nasdaq-100 Index, or a Nasdaq-100 index ETF.

When QQC’s managers buy a call option, the fund is reserving the right (but not the obligation) to purchase a security at a specific price, called a strike price, within a set amount of time. Inversely, when QQC buys a put option, it reserves the right to sell that security at the strike price upon expiration.

QQC always holds some options contracts, to help the fund protect against or capitalize on market moves. The “convexity” concept refers to the fact that performance is never meant to linearly tie to the market in times of upward and downward movement, but instead is designed to rise greater than and fall less than broad market moves.

QQC carries an expense ratio of 0.45% currently due to a contractual agreement by the fund’s adviser through November 30, 2021.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.