By Liqian Ren, Director of Modern Alpha

We recently spoke with portfolio manager Jeff Jiangfeng Li from EFG Asset Management on our China of Tomorrow podcast.

Jeff currently manages a China equity fund and a global equity fund. Trained as an engineer, his team manages funds as active fundamental managers, with quantitative guardrails for risk management.

Jeff goes into the details of his investment process, which is consistently applied across his portfolios. The theme is to look for companies where valuation is still reasonable given expected profitability growth.

As we’ve also been advocating this past year, Jeff thinks China investors could be rewarded for broadening their investments away from media-focused leaders like Tencent and Alibaba toward less well known growth companies.

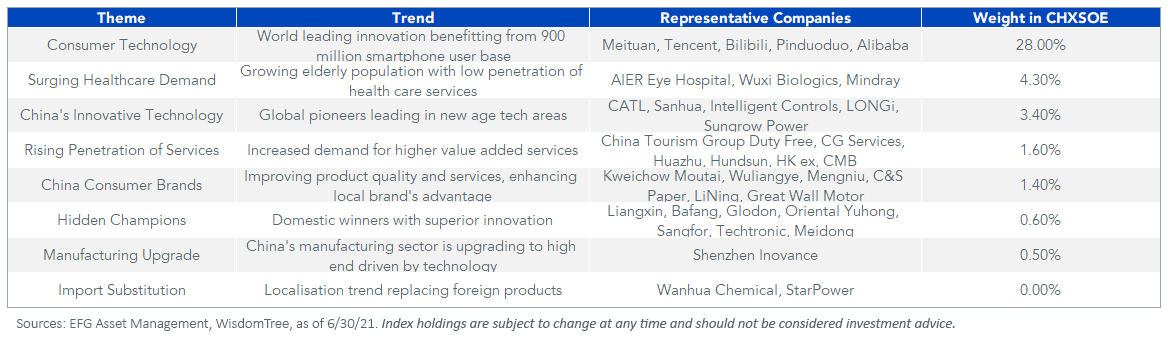

Below are EFG’s eight Chinese growth theme company ideas. The WisdomTree China ex-State-Owned Enterprises Index (CHXSOE) has broad exposure to each of these themes.

We maintain our focus on non-state-owned companies as a fundamental theme of investing in China. China’s growth rates have been adjusted down. The trend of China’s growth rate is much closer to the 4.5%–5.5% range for the near future, and we believe the best indicator of whether the country’s growth is on a good trajectory is whether its non-state-owned economy is able to grow amid the complex and state-dominated social environment. Recent news about companies like Didi and Alibaba show the idiosyncratic risk of one company and the benefit of investing in a broad basket of ex-SOE companies.

You can listen to our full conversation below.

Originally published by WisdomTree, 7/19/21

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.