As the Delta variant sweeps across the globe, pharmaceutical and biotech companies are working to ensure vaccines continue to cover the population, as well as working on booster doses that can adapt to future mutations.

“Delta has gone the way we were hoping it wouldn’t. Delta’s gotten more contagious, probably more serious as an infection and is spreading much, much faster,” said Ben Cowling, HKU Professor of Infectious Disease Epidemiology, in a recent interview with Bloomberg.

And now there’s another variant, Lambda, which is emerging in South America. “It’s very, very concerning. It seems to be get around the vaccine more so than Delta,” said Cowling.

mRNA vaccines such as the Pfizer and Moderna vaccines tend to last longer than their non-mRNA counterparts like Sinovac and Johnson and Johnson, which will likely require booster shots more frequently. For example, Pfizer’s BioNtech shot has shown in a study to produce 10 times more antibodies than Sinovac.

“What we’re hoping for is maybe 2.0, Biontech version 2.0, Moderna version 2.0, maybe others, which are specifically against the Delta variant,” Cowley said. He explained that an advantage mRNA vaccines have over other types of vaccines is that they can be adapted very quickly.

Either way, Cowling believes that Covid-19 and all of its continuing variants are here to stay.

Making Plays on a Biotech Bull

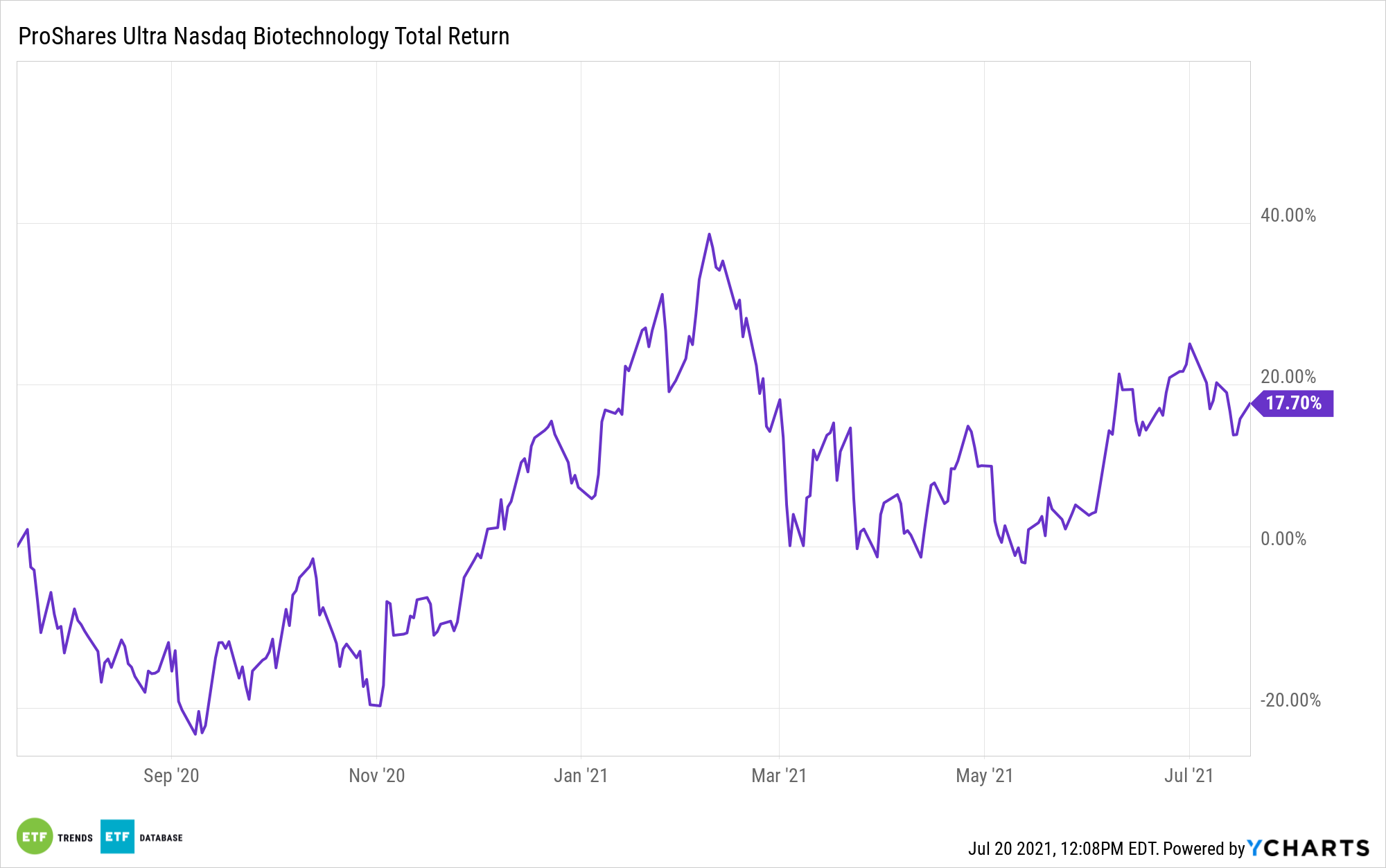

As the COVID-19 pandemic intensifies, many biotech firms are offering additional opportunity for investors. The ProShares Ultra Nasdaq Biotechnology ETF (BIB) is a leveraged option for investors looking for exposure into biotechnology and pharmaceuticals during bullish times for the industry.

The fund captures twice the daily return of the underlying Nasdaq Biotechnology Index before fees and taxes. The exposure resets daily, and as such, does not provide a simple 2x multiplier on the return of the underlying index.

As such, BIB should be monitored regularly by potential investors.

By utilizing swap agreements with major banking institutions, as well as investing in shares of the companies tracked within the Index, such as Moderna (MRNA), BIB rebalances daily to align with the Index.

BIB carries an expense ratio of 0.95%, with a contractual waiver that ends 9/30/21.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.