Derivatives markets can play an important role in facilitating a low-carbon economy transition, but regulators must be vigilant to ensure that climate change does not threaten market stability, said Commissioner Dan M. Berkovitz of the Commodity Futures Trading Commission (CFTC) in recent public remarks.

His keynote address was wide-ranging and touched on a number of intersections between climate change and the derivatives markets, such as carbon trading markets.

Secretary of the Treasury Janet Yellen warned recently in her inaugural appearance of the “existential threat” of climate change to the U.S. financial system and markets. Commissioner Berkovitz took the warning a step further and laid out the fundamental ways that the CFTC could help support the transition to a carbon-neutral economy, a goal that is vital to the health of financial markets long-term.

One way that the CFTC can help support the transition to zero emissions within the financial realms is to protect the integrity of the climate derivatives markets, which starts with having a firm handle on how the carbon derivatives markets trade and function.

The Commission, he explained, “must be aware of how the various primary, secondary, and derivative carbon markets are interacting and how companies use these markets to meet their compliance obligations, manage risks, and discover prices.”

In the week prior to the meeting, the CFTC Energy and Environmental Markets Advisory Committee met to analyze and discuss the increasingly important role of carbon markets in transitioning to a low- or zero-emission economy. Berkovitz cited the need for the CFTC to work with other regulatory agencies to create a standard for products traded in the carbon markets. He also expressed the importance of the role that the derivatives markets could have in helping transition from current emission standards to the low carbon ones necessary in the future.

The role of “existing carbon markets and the future expansion of those markets indicates that carbon trading may provide a significant new asset class for climate-related risk management and investment purposes,” said Berkovitz.

A second goal of the CFTC going forward should be to help companies reduce their exposures to climate harming practices. This includes working with “exchanges and market participants on the development and approval of new products that are intended to help companies hedge their climate-related risks.”

Lastly, the CFTC can be responsible for “appropriate management and disclosure of climate-related risks.”

Carbon Derivatives Investing with KRBN

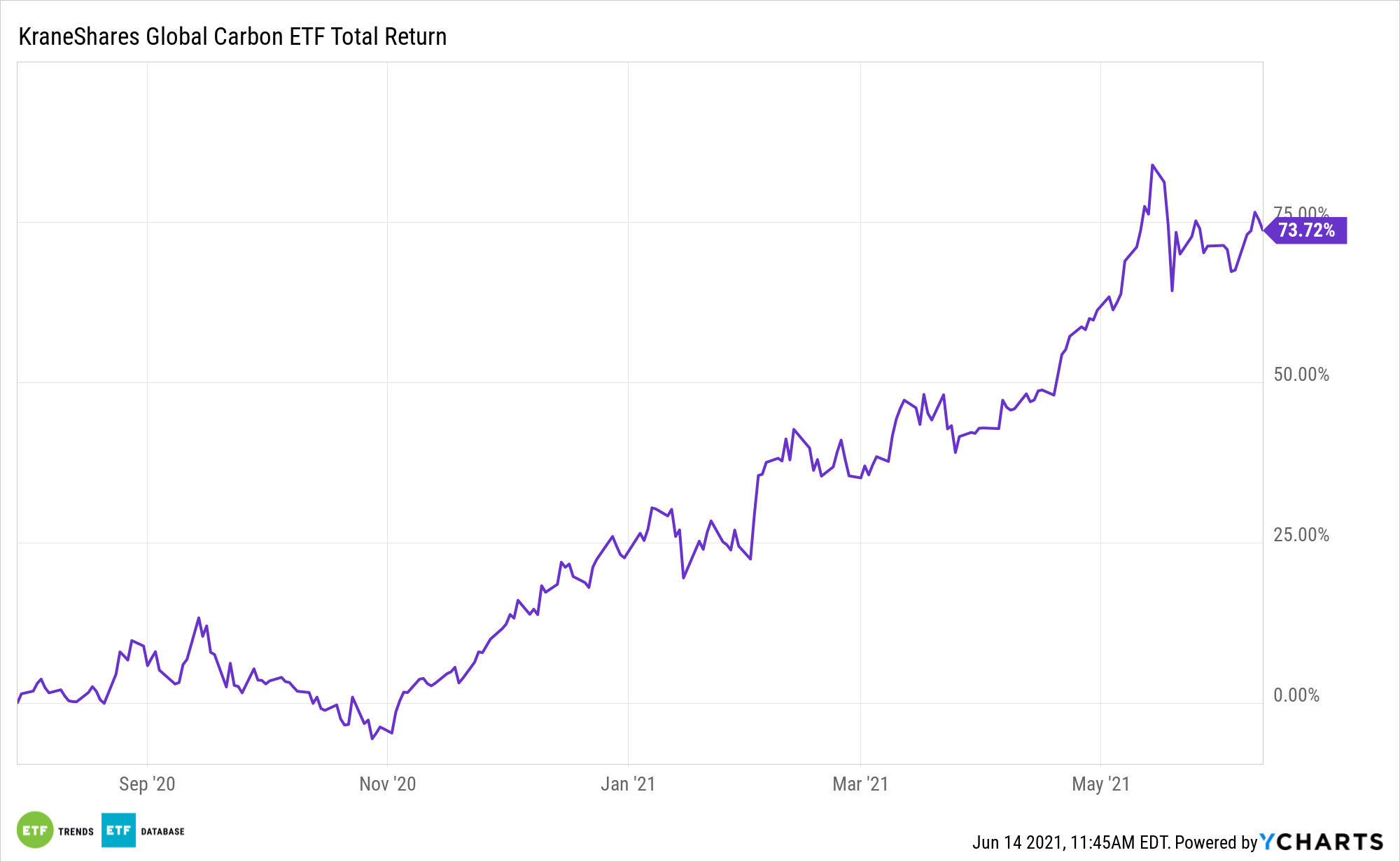

Investors looking for exposure to the growing carbon derivatives markets can consider the KraneShares Global Carbon ETF (NYSE: KRBN), which offers exposure to the global carbon credits trading market.

KRBN tracks the IHS Markit Global Carbon Index, which tracks the most liquid carbon credit futures contracts in the world.

This includes contracts from the European Union Allowances (EUA), California Carbon Allowances (CCA), and the Regional Greenhouse Gas Initiative (RGGI) markets. North American pricing data is supplied by IHS Markit’s OPIS service, while European prices are supplied by ICE Futures Pricing.

As of December 31, 2020, those three carbon futures markets had a market size of $260.79 billion.

For more news, information, and strategy, visit the China Insights Channel.