This post is going to cover what I believe is the most important question for portfolio diversification today: are bonds losing their role as the preferred hedge asset and portfolio diversifier that they’ve held for the last two decades?

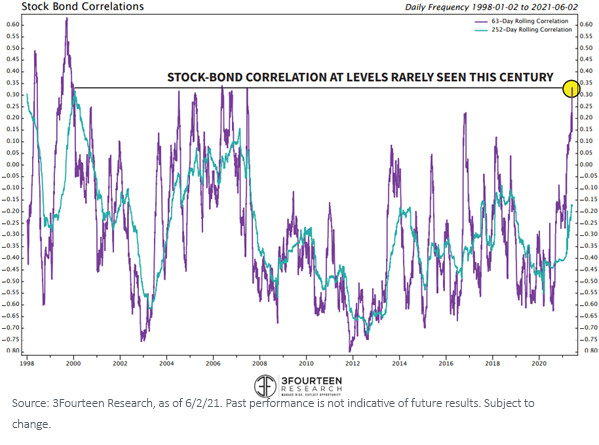

Based on 63-day rolling correlation window analysis conducted by Warren Pies, founder of 3Fourteen Research, equity-bond correlation levels have spiked to levels rarely seen in the last two decades. These rising correlations—if they persist or rise even higher—would imply that bonds are starting to lose their diversification benefits, and there could be a time in the near future when stocks and bonds decline together.

In the past, we’ve assumed that on negative days for equity markets there would be bids in the U.S. Treasury bond market that would cause bond yields to fall and their prices to rise.

With the market starting to fear the consequences of rising inflation pressures—a narrative voiced by our Senior Investment Strategy Advisor, Wharton Professor Jeremy Siegel—it could be elevated for a number of years to come.

Rising rates could put some pressure on the stock market, and you’d lose this diversification property that bonds have historically provided.

3Fourteen Research highlights the importance of real assets like commodities, gold and oil for their inflation hedging properties—and 3Fourteen currently runs a dynamic, real asset model that is heavily allocating to all those assets in proportions that would be uncommon in traditional 60% equity/40% fixed income portfolio frameworks.

Worst Day Analytics

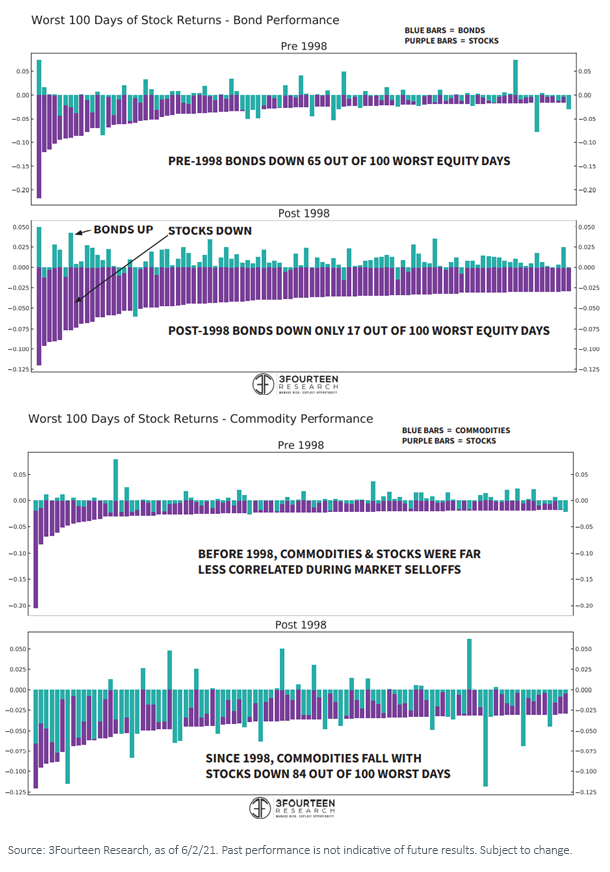

Evaluating performance on some of the worst trading days for equities can shed light on the value of diversifiers.

Looking at the 100 worst trading days for equities since 1998, bonds had a negative return on only 17 of them, showing that bonds served as a productive hedge asset over 80% of the time.

But if you look back before 1998, that relationship was more precarious. It was more likely that bonds also had a negative return on down days for stocks, as bonds were down on 65 of those 100 worst days for equities.

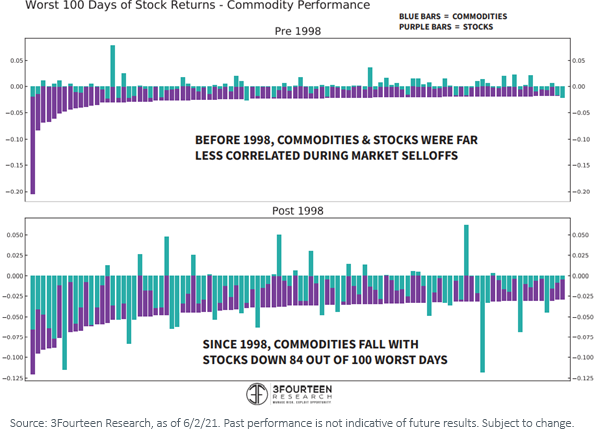

Interestingly, commodities had the opposite experience.

Since 1998, commodities returns were in sync with equities, declining on 84 of the 100 worst trading days for stocks. But before 1998, commodities were only down on 53 of those worst trading days for equities, in some ways being even better diversifiers than bonds.

Commodities were in a brutal bear market for much of the last decade. There was not much inflation, and the structure of the commodities futures market was in contango such that the cost to roll futures eroded any gains to be made in spot prices.

During the last six to seven months, and particularly in 2021 to date, commodity prices have rebounded significantly, with both supply constraints and reopening demand creating this perfect mix of upward pressure on commodity prices.

The market dynamics look to be shifting such that bonds could be losing some of their historical dominance as the preferred portfolio diversifier. Commodities and managed futures strategies that rely heavily on commodity exposures are two places investors might look for new diversifiers within this changing macro regime. For two possible solutions, consider the WisdomTree Enhanced Commodity Strategy Fund (GCC) and the WisdomTree Managed Futures Strategy Fund (WTMF).

Originally published by WisdomTree, 6/21/21

Important Risks Related to this Article

No level of diversification or non-correlation can ensure profits or guarantee against losses. GCC: There are risks associated with investing, including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk, and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors which contribute to the Fund’s performance. These factors include the use of commodity futures contracts. Derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The value of the shares of the Fund relate directly to the value of the futures contracts and other assets held by the Fund and any fluctuation in the value of these assets could adversely affect an investment in the Fund’s shares. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Commodities and futures are generally volatile and are not suitable for all investors. Investments in commodities may be affected by overall market movements, changes in interest rates and other factors such as weather, disease, embargoes and international economic and political developments.

WTMF: There are risks associated with investing, including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk, and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors which contribute to the Fund’s performance, as well as its correlation (or non-correlation) to other asset classes. These factors include the use of long and short positions in commodity futures contracts, currency forward contracts, swaps and other derivatives. Derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The Fund should not be used as a proxy for taking long only (or short only) positions in commodities or currencies. The Fund could lose significant value during periods when long only indexes rise (or short only) indexes decline. The Fund’s investment objective is based on historic price trends. There can be no assurance that such trends will be reflected in future market movements. The Fund generally does not make intra-month adjustments and therefore is subject to substantial losses if the market moves against the Fund’s established positions on an intra-month basis. In markets without sustained price trends or markets that quickly reverse or “whipsaw,” the Fund may suffer significant losses. The Fund is actively managed thus the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.