By JAForlines

2017 has been outstanding year for our Global Tactical Portfolios. All four have registered substantial outperformance against their benchmarks and peer groups.

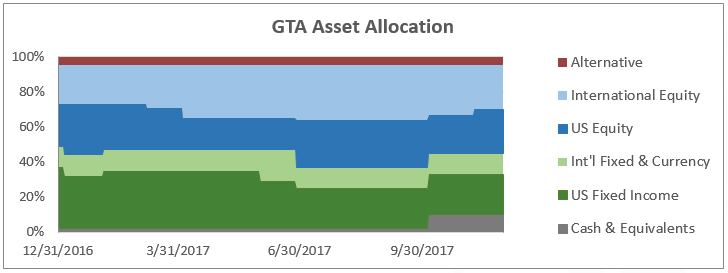

One of the hallmarks of the macro environment in 2017 was the calm that presided over most markets, enabling us to focus on more minor trends and events. We were cautious in our exposure to long-duration fixed income, rewarded for our careful US sector selection, and we capitalized on international equity outperformance.

Following the 2016 US elections, US dollar interest rates rose sharply. Responding to this move, we shifted our fixed income allocation to 100% US dollar denominated securities in order to take advantage of the more favorable interest rate environment. We argued that the spreads between US dollar rates and many major international peers were at or near all-time highs, and therefore were more likely to converge than continue to diverge. This enabled us to earn higher yields in relative safety.

US equity sector selection was a major source of attribution. Our core positions—technology, financials, biotech, and aerospace & defense—delivered impressive returns, and our adjustments were well-timed. We exited our positions in small-cap and regional banks early in the year when the “Trump reflation rally” was losing steam, we initiated a position in the energy sector in late June, avoiding the first-half selloff, and made a timely exit from our biotech position in October.

We were also rewarded for our international equity exposure. After avoiding emerging market equities for years, we added significant exposure and participated in their recovery. For most of the year, we held large positions in European equities, which were supported by prospects for deeper European integration. However, a disappointing result to the German election in September diminished those prospects, and we exited our European positions entirely. At the same time, we increased our exposure to Japanese equities, which we believe are at the beginning of major move higher.

![]() Some Advisors were surprised that we were able to produce strong outperformance in a year that lacked any major “macro events.” While protection against such events is one of the primary goals of our portfolios, they are designed to be able to outperform in all markets. A stable macro environment allows us to focus on our duration, sector, and country exposures—it enables us to enter and exit positions at our own choosing, instead of being dictated to by larger events and factors. Our goal is to deliver a happy holiday season to our Advisors and clients every year!

Some Advisors were surprised that we were able to produce strong outperformance in a year that lacked any major “macro events.” While protection against such events is one of the primary goals of our portfolios, they are designed to be able to outperform in all markets. A stable macro environment allows us to focus on our duration, sector, and country exposures—it enables us to enter and exit positions at our own choosing, instead of being dictated to by larger events and factors. Our goal is to deliver a happy holiday season to our Advisors and clients every year!

We hold a tactical cash position in our GTC, GTA, and GTG portfolios. While we remain constructive on equities in the intermediate-term, the short-term risk factors suggest to us that a more conservative approach is prudent for now.

We are avoiding foreign currency fixed income to benefit from higher US dollar interest rates. We expect spreads between US dollar and foreign currency interest rates to narrow, and therefore will benefit by concentrating all of our fixed income exposure in US dollar denominated holdings.

We are avoiding foreign currency fixed income to benefit from higher US dollar interest rates. We expect spreads between US dollar and foreign currency interest rates to narrow, and therefore will benefit by concentrating all of our fixed income exposure in US dollar denominated holdings.

We are avoiding long duration fixed income in our portfolios. Interest rates may rise in 2018 as economic growth remains strong, inflation reemerges, and global central banks step away from the “extraordinary measures” they employed during the financial crisis.

We have exposure to four US equity sectors: financials, technology, energy, and aerospace & defense. Financials benefit directly from a higher interest rate environment in the US, as well as a more favorable tax and regulatory environment which is likely to develop. The pace of disruption of old industries by new products and processes has continued to accelerate, and technology gives us exposure to this process of creative destruction. Strong economic growth will support global energy markets, and inflation may reemerge in 2018, which will support the energy sector. Global military spending will increase in coming years, as US hegemony fades and a multi-polar world emerges—the aerospace and defense industry will be a beneficiary.

Japanese equities are supported by favorable valuations, accelerating economic and earnings growth, the Bank of Japan’s ongoing aggressive monetary easing, and global money managers’ underweight exposure. We hold positions in both large- and small-cap equities, and have not hedged any of our Yen exposure.

Emerging market equities benefit from positive capital inflows and represent attractive relative value. We expect global capital flows to remain supportive and emerging market equities to continue to “catch up” after years of underperformance. Asia, in particular, represents an excellent opportunity.

Gold’s status as an alternative currency should support it as geopolitical risks and policy uncertainty remain elevated. Furthermore, as an asset with low correlations to most others, it helps lower overall portfolio volatility.

Recent GTA Portfolio Changes

We have increased our exposure to the US energy sector. The US economy is now producing above its potential (leading to a negative output gap), and unemployment is below its long-term equilibrium, which together make the reemergence of inflation more likely in 2018. The US energy sector should be a beneficiary.