The fear among some analysts when QE was implemented was that it would spur inflation. This was based on Fisher’s monetary identity, which is that money supply times velocity is equal to the price level times available supply, or MV=PQ. If Q, which represents the productive capacity of the economy, is fixed, and V is thought to be dependent upon the institutional arrangements for the circulation of money, and thus mostly fixed as well, raising M will only lead to higher P. If there is slack in the economy, Q could rise with steady prices, leading to

higher real output. However, at full employment, inflation is the only result.

In fact, what happened is that the reserves sat harmlessly on bank balance sheets, while the real economy grew slowly and velocity plunged. The chart below shows annual velocity of money (GDP/M2, or using the identity, V=PQ/M). Note that during the Great Depression, velocity plunged then as well. Economists during this period soured on monetary policy and mostly focused on fiscal policy. That shift of fiscal policy didn’t occur during the 2008 Financial Crisis.

It is unclear why expanding the money supply failed to boost lending. However, deleveraging was common to both periods of low velocity.

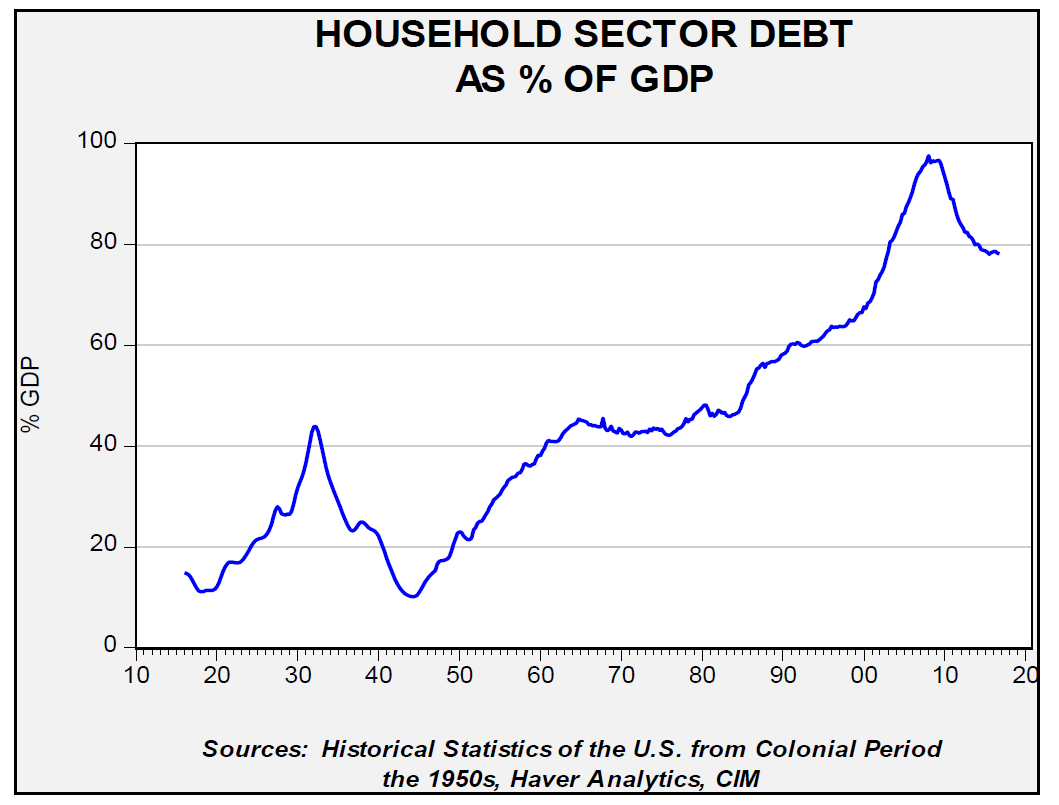

This chart shows household debt as a percentage of GDP. The plunge in the early 1930s coincides with a steady decline in household debt; the same is true now.1 If there is a drop in demand for loans, injecting reserves into the banking system won’t have much impact on the real economy. Conversely, shrinking the balance sheet should do nothing more than reduce the level of excess reserves on commercial bank balance sheets.

This article is courtesy of Confluence Investment Management, a participant in the ETF Strategist Channel.

1. It is interesting to note that velocity did rise in the early 1930s during the Great Depression. This was due to a horrific policy error where the Federal Reserve tightened policy into the teeth of the downturn, triggering a deeper drop in growth.

Disclosure Information

Past performance is no guarantee of future results. Information provided in this report is for educational and illustrative purposes only and should not be construed as individualized investment advice or a recommendation. The investment or strategy discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Opinions expressed are current as of the date shown and are subject to change.

This report was prepared by Confluence Investment Management LLC and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change. This is not a solicitation or an offer to buy or sell any security.