We view Japanese equities as the 7th most attractive investment out of a universe of 34 liquid investable countries. Japan stands out with stronger than average (and improving) fundamentals with below average risk. Furthermore, Japanese equities exhibit attractive value, with the country’s overall value profile coming in at 7th overall in April.

Considering the rhetoric and policy coming from the Bank of Japan, the key question for any investor considering Japanese equities is whether or not to hedge the equities for Yen weakness. We recommend hedging. The Yen is testing a key Fibonacci support level (50% retracement of the November 2016 to December 2016 weakening), and momentum indicators suggest that Yen strength has hit resistance.

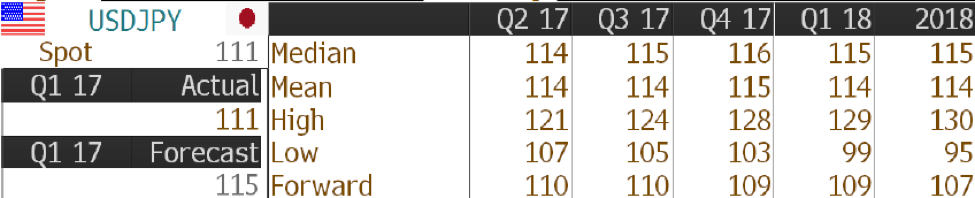

Bloomberg consensus forecasts point towards an average weakening of 4% to 5% through year end. A meaningful alpha opportunity for global investors.

Lastly, the interest rate differential between US 5 year treasuries and Japanese 5 year government bonds is near a 5 year high, further supporting the fundamental case for Yen weakness relative to the US Dollar.