Ireland may be the “all-time” example of higher collected revenues from lower corporate tax levies. The country was collecting only 1.5% in corporate taxes as a percent of GDP in 1982 when the tax rate was 50%, but with a rate of 12.5%, Ireland’s collected corporate taxes now amount to 2.7% on a GDP base that is 11.6 times larger.

In the U.S., small and mid-sized companies comprise 99% of all firms, employ around half of the country’s workforce, and account for more than 60% to 70% of the job growth in our country. When President Reagan took office, he lowered the top marginal bracket from 70% to 28%. The Cato Institute developed some numbers based on the report, “Statistics of Income (SOI)” from the IRS.

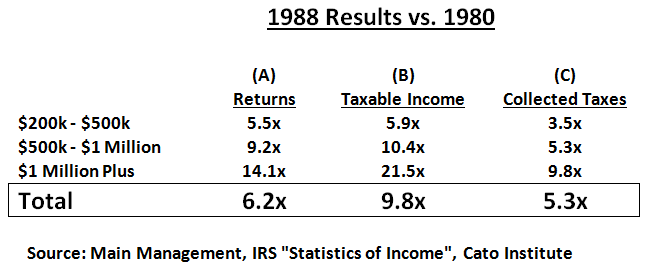

The Cato team looked at the income earners over $200,000. As can be seen in the table below, the number of “rich” filers back in 1980 totaled 116,757. Those filers had taxable income of $36.2 Billion and paid taxes of $19.0 Billion, which works out to a melded tax rate of 48.9%. Fast forward to 1988 when the top marginal rate was 28%, the number of filers who earned over $200,000 rose 6.2 times to 723,697. The 1988 “rich” filers reported taxable income of $353 Billion of income, up 9.8 times from 1980 and paid taxes of $99.7 Billion, up 5.3 fold from 1980.

Even if the impact from a higher population base with a better economy and some inflation were aggregated, those factors would only contribute a theoretical gain of around 50% – not the realized experience of a five fold increase in collected taxes.

We believe there will be a budget deal. We suspect the possibilities are that (i) a 50% probability that the House plan is passed close to its current form which cuts taxes, reduces the number of individual tax brackets, broadens the base, and reforms the code, or (ii) a 30% probability that the Trump plan gets pushed through which would cut rates to 15%, or (iii) a 20% probability that a tax plan is instituted that only tweaks the code, lowers rates only slightly, and doesn’t impact the deficit much.

If a deal does get approved, we believe smaller companies will benefit more than larger ones, as they will receive a greater post-tax bump in profits. Accordingly, small cap ETFs such as the IWM (iShares Russell 2000 ETF) or IWC (iShares Micro-Cap ETF) may warrant a closer look.

To request an expanded version of this analysis, please contact us at [email protected].

Richard Fredericks is a founding partner of Main Management, a participant in the ETF Strategist Channel.

A pioneer in managing all-ETF portfolios, Main Management LLC is committed to delivering liquid, transparent and cost-effective investment solutions. By combining asset allocation insights with smart implementation vehicles, Main Management offers a unique approach that translates into distinct advantages for our clients, including diversification, cost efficiency, tax awareness and transparency. http://www.mainmgt.com