Stocks and bonds are staples of many investment portfolios, but that leaves investors open to potential risks, especially in an extended bull market. On the other hand, one may consider commodity exchange traded funds to navigate the changing environment ahead and help diversify a traditional portfolio.

On the recent webcast, What’s Next for Broad Commodities? Key Themes and Portfolio Solutions, Maxwell Gold, Director of Investment Strategy at ETF Securities, pointed out that as the global economy continues to push forward, inflationary pressures will also rise.

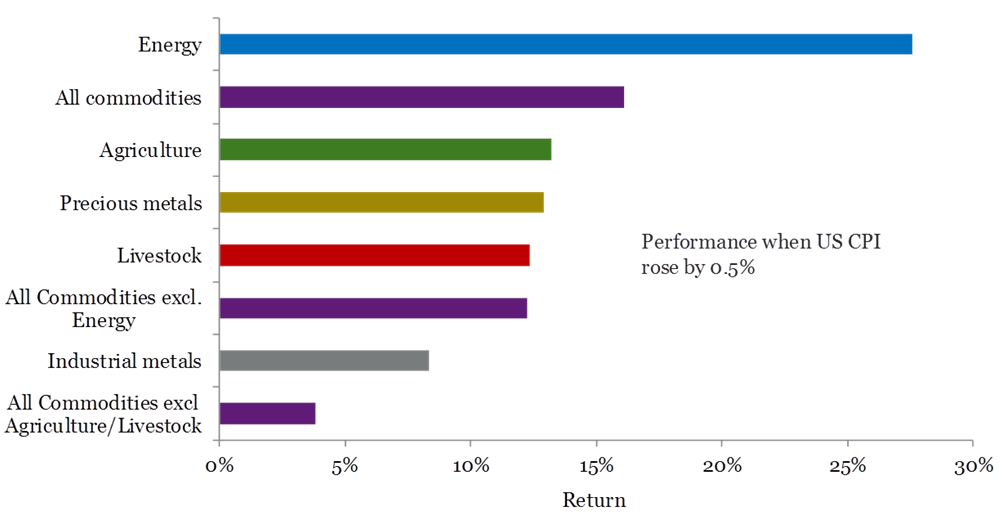

Consequently, investors should consider assets like commodities to help maintain the purchasing power of their investment portfolios. For instance, over the past 26 years when the U.S. Consumer Price Index rose by 0.5%, energy has been among the best performing assets, returning over 25%, while the broader commodities market returned over 15%.

Investors should also consider alternative assets like commodities as the equities bull market enters its ninth year, with high valuations and low yields creating an unattractive landscape that is exposed to greater short-term risks. Over the past 26 years, commodities have displayed low correlations to other asset classes such as equities and fixed-income, Gold said.