By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

In the past, many Financial Advisors saw little value in actively managing fixed income. All one had to do was build a bond ladder based on the available inventory of high quality bonds and earn 6%. When a bond matured or was called, roll it to another bond and earn 6% again.

Obviously, the world has changed as interest rates have fallen dramatically. What is less well known for many, is that risks have spiked at the same time that yields have fallen. The collapse in yield has led to a corresponding increase in both interest rate risk and credit risk.

In the old days, increasing yield often meant simply using longer-dated maturities or moving down the quality ladder toward high yield bonds, or both. And again, clip the coupon, roll the paper, and earn a sufficient return.

The fixed income landscape today is very different. Simply employing either or both of those approaches may lead to outsized risk, significant volatility, losses, and headaches.

Paying More To Get Less

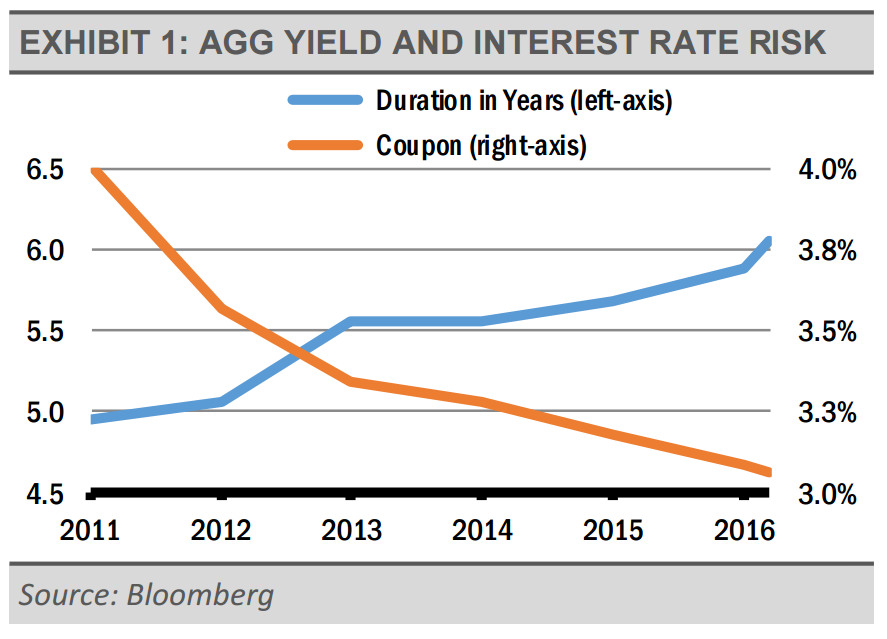

If risk is the price of return, then today’s fixed income market makes quite the conundrum for investors. For example, as the following graph shows, while the interest rate on the Bloomberg Barclays Aggregate Bond Index has declined since 2000, interest rate risk, as measured by duration, has spiked nearly 30%. This is just a function of the math involved with bonds. For the same maturity date, a lower coupon bond will have higher interest rate risk than a higher coupon bond, all else being equal.