Investors who are worried about potential volatility in an extended bull market environment can consider alternative exchange traded fund strategies to hedge or ride the short-term swings.

On the recent webcast, Scaling the Wall of Worry: The Power of Flexibility in Volatile Markets, Taylor Lukof, Founder and CEO of ABR Dynamic Funds, pointed out that while the equities and fixed-income markets have experienced a great run over the years, the two asset categories are now trading at very expensive valuations, leaving investors and advisors exposed to sudden swings. Consequently, Lukof suggested investors should consider volatility as part of a diversified asset allocation model.

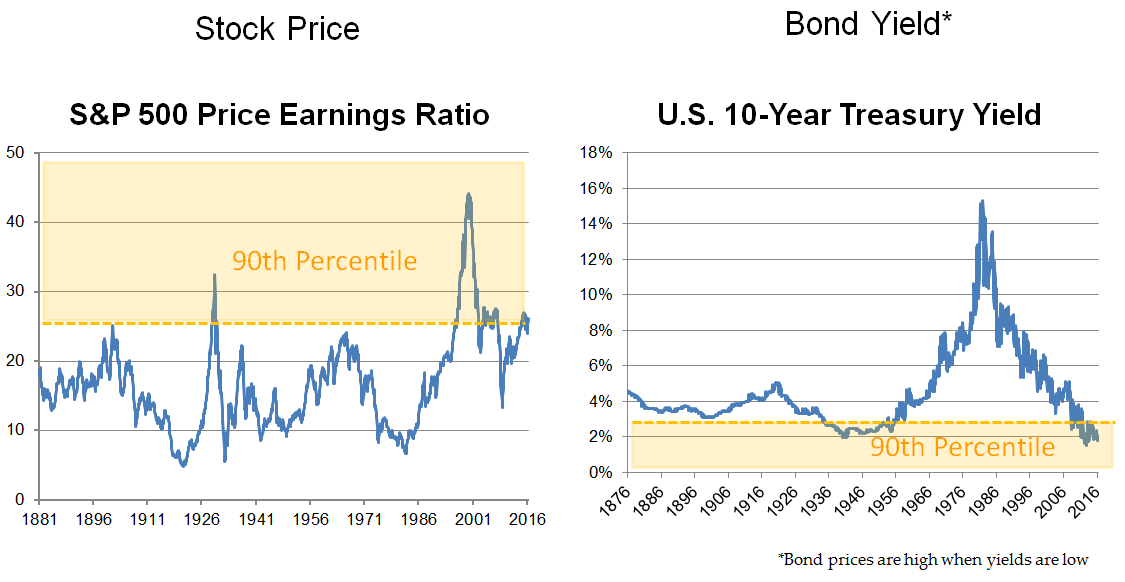

Currently, both the S&P 500 price-to-earning ratios and U.S. 10-year Treasury yields are hovering around their 90th percentile on a historic basis, or the two traditional assets are trading near historical highs.

As we consider ways to hedge against potential short-term risks, investors may look to alternative assets like volatility, which has exhibited a long-term asset class correlation to the S&P 500 of -0.75 – a -1 reading would reflect a perfectly uncorrelated asset.

Alternatively, Sylvia Jablonski, Managing Director and Institutional ETF Strategist at Direxion, argued that advisors may consider leveraged and inverse ETFs to hedge rising risks in an extended bull market.

Jablonski explained that these leveraged and inverse ETFs try to magnify the returns of their benchmarks on a daily basis.

Leveraged and inverse ETFs “allow investors to gain exposure without the need for full dollar-for-dollar investment,” Jablonski said.