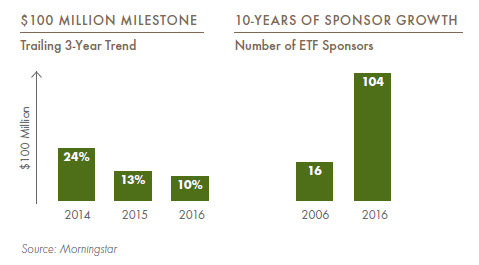

During the past two years, 534 new ETFs were listed with 54 (10%) of these funds exceeding the $100 million AUM milestone. This ratio decreased from 2015, when 13% of funds launched within the trailing two years exceeded the $100 million milestone.

Competition continues to intensify as new players enter the market. We assert that the keys to success in our industry are evolving due to changing investor attitudes and competitive dynamics. The number of U.S. sponsors has increased from 16 at the end of 2006 to 104 at the end of 2016. A net increase of 13 sponsors occurred in 2016.

Product Innovation

From my perspective, there are four distinctive phases of product innovation in the exchange traded funds market.

The first stage focused almost exclusively on broad-based equity benchmark indexes. Institutions were the initial users of these benchmark indexes in tactical applications, such as hedging and transition management.

Over time, usage migrated to advisors and other strategic investors, along with products designed to track benchmark indexes, which continue to account for the majority of ETF assets.

The second stage of innovation was distinguished by an expansion into a variety of asset classes including fixed income, commodities and real estate. Driven by investor demand for global portfolio exposure and rising demand from advisors, ETFs democratized access to these asset classes. This stage of innovation was also marked by rising awareness and usage among retail investors. The third leg of innovation has been distinguished by investor demand for distinctive investment strategies with particular interest in funds that track alternatively weighted indexes.

A variety of nomenclature is associated with these strategies including fundamentally weighted, factor weighted and the popular “smart beta.” While the lexicon may vary, the trend of growing investor demand for alternatively-weighted index strategies is firmly established. The term “smart beta” is increasingly being used by investors and Morningstar® identifies 634 funds with the term “strategic beta,” up from 515 funds the prior year. With assets of $559 billion and inflows of $50 billion in 2016, this sub-segment continues to experience strong organic growth. It is relevant to note that flows to strategic beta* funds fell short of the prior year modestly outpacing the industry growth rate (21% versus 20%).

FlexShares is a leader in this segment with 23 of our 25 funds tracking alternatively weighted indices.

New stages of innovation are generally ignited in the midst of an ongoing phase. The drive toward investment strategies that efficiently capture compensated risk factors and active risk,has accounted for much of the interest in alternatively weighted index strategies. This trend, coupled with continued fee compression, has given rise to a fourth stage of innovation. The fourth stage of innovation is characterized first by budding interest in actively managed ETFs. Secondarily, it is characterized by rising

interest in multi-asset class solutions, in which ETFs are the preferred fulfillment vehicle. Actively managed ETFs were first introduced to the market in 2008. At the close of 2016, there were 169 U.S. listed and actively managed ETFs with $30 billion inassets. While the number of new funds continues to grow, active ETFs only account for just over 1 percent of U.S. ETF assets.

Broader utilization of actively-managed ETFs will be aided by targeted regulatory relief, market entry by established active fund managers and the tried and true passage of time. Additionally, asset managers are offering increasingly popular multi-asset class products and managed portfolio solutions comprised of ETFs. These solutions may incorporate dynamic or tactical asset allocation and may integrate active and passive components.

The trend toward multi-asset class products is a key driver of the emerging fourth stage of product innovation. This phase of innovation is blurring, if not removing altogether, industry distinctions between active and passive portfolio solutions.

Our product strategy at FlexShares remains principally focused on alternatively weighted index strategies with selective implementation of actively managed strategies.

The FlexShares’ philosophy is built around the way investors think. Investors have clear objectives. We develop investment strategies that seek to meet those objectives. When it comes to delivering an index-based strategy, the index matters. This is why our comprehensive approach, known as Flexible Indexing, entails innovative index construction for each FlexShares fund. The entire development process is centered on investor needs.

Click here to view the full FlexShares President’s Perspectives whitepaper.