This year has seen another crowded field of new exchange traded funds come to market and within that group are plenty of niche funds, indicating that ETF issuers continue to slice and dice investment ideas into increasingly fine fund packages.

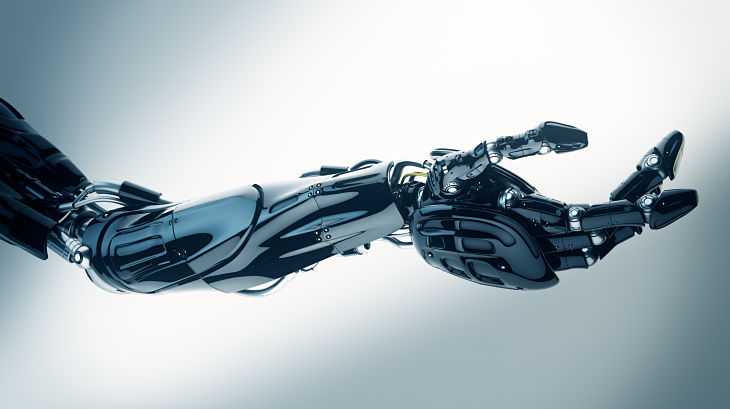

The Global X Robotics & Artificial Intelligence Thematic ETF (NasdaqGM: BOTZ) is one of those niche funds. BOTZ provides exposure to companies involved in the adoption and utilization of robotics and artificial intelligence (AI), including those involved with industrial manufacturing, medicine, autonomous vehicles, and other applications.

BOTZ follows the Indxx Global Robotics & Artificial Intelligence Thematic Index. The ETF, which debuted in September with the Global X FinTech Thematic ETF (NasdaqGM: FINX) and the Global X Internet of Things Thematic ETF (NasdaqGM: SNSR), holds 28 stocks with an average market cap of $8.8 billion, putting the ETF in mid-cap territory.

“BOTZ is situated in a long-term growth sector with massive upside potential. With the emerging self-driving automobile industry on the rise, the likelihood of robotics and artificial intelligence playing an active role in consumer lives in the near future is increasing daily,” according to a Seeking Alpha analysis of the ETF.

SEE MORE: PureFunds Adds Tech ETFs Focused on Financial, Health Care Services