Smart beta ETFs are all the rage at the moment and are capturing an increasingly large share of the ETF marketplace.

Yet the growth hasn’t spread as rapidly into the emerging market space. The purpose of this piece is to take a quick look at the emerging market ETF universe, examine some of the reasons why smart beta hasn’t taken off, and list a few ETFs that may be worth a hard look.

State of Emerging Markets ETFs

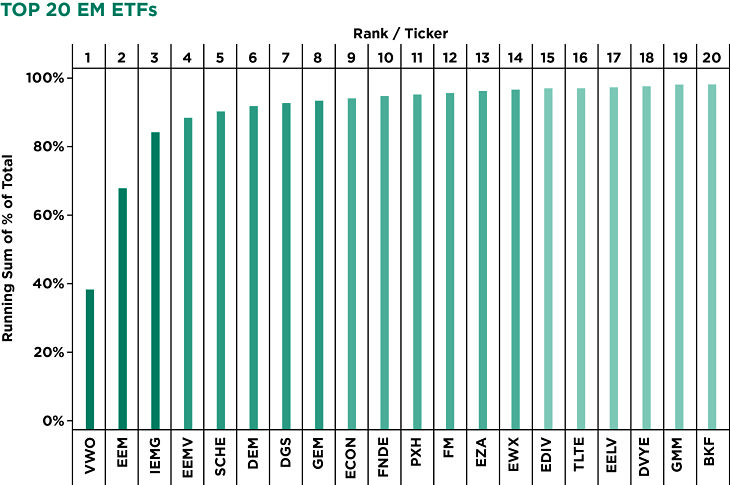

The chart below shows the largest 20 of the 71 emerging market ETFs in rank order. Vanguard FTSE Emerging Markets (VWO) has a 40% market share, followed by iShares MSCI Emerging Markets (EEM) and iShares Core MSCI Emerging Markets (IEMG). Combined, the big three control more than 80% of the market. The top 10 control 95% of the assets, and the top 20 control 98%.

In his book, “The Long Tail: Why the Future of Business Is Selling Less of More,” Chris Anderson describes a power law distribution, where the market share of an item is predicted by dividing the top market share item’s assets or sales by the rank of the item in question. So the second-ranked item would have half the assets as the first [assets of market leader divided by two (its rank)]. The tenth ranked item would have divided the assets of the market leader by 10. [i]

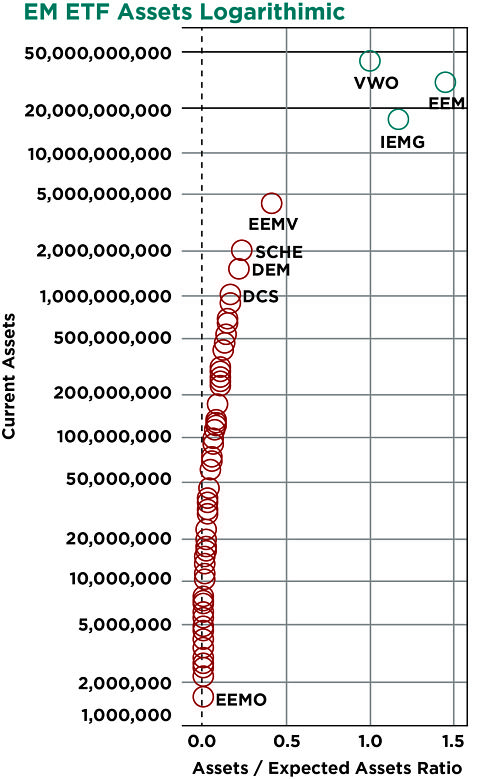

The second chart shows that the emerging market ETF segment has a big gap between expected assets and current assets. The left side shows current assets and the bottom takes the current assets and divides them by the expected assets, using the formula explained above. In this case, no ETF beyond the big three has half the assets expected. The intensity of the colors show how far the current assets deviate from its expected value.

Why Are Assets so Concentrated?

Emerging market investors concentrate their assets in a few ETFs because investors shy away from factors when analyzing emerging markets and because low trading volume keeps investors in familiar names. These two causes have a chicken-or-egg quality about them. If more investors focused on smart beta factors, then volume would be higher. If volume rose, more investors would use emerging market smart beta ETFs.

Emerging market investors concentrate their assets in a few ETFs because investors shy away from factors when analyzing emerging markets and because low trading volume keeps investors in familiar names. These two causes have a chicken-or-egg quality about them. If more investors focused on smart beta factors, then volume would be higher. If volume rose, more investors would use emerging market smart beta ETFs.

Instead, investors seem content to stop with a highly diversified emerging market allocation in many cases. Those investors who venture beyond broad ETFs target exposures to regions and countries rather than the factors that support most smart beta ETFs.

Because investors haven’t been willing to step out of their comfort zones, spreads remain wide. While issuers remind ETF strategists, such as CLS, that large orders can be placed at reasonable spreads, they forget that new clients join our models all the time. Those clients rely on ETF liquidity, and their trading costs can be quite high.

Issuers need to do a better job of launching ETFs with higher initial balances, tighter spreads, and ongoing volume. Launching a smart beta emerging market ETF with $5 million seed hasn’t worked so far.

Any Opportunities?