Wow. Our Brexit moment! We just witnessed a political revolution in the U.S. that hasn’t been seen since Ronald Reagan in 1980.

The populist movement that began on the other side of the pond has carried over to our shores. Mohamed El-Erian tweeted last night, “Politics of anger in play. Directly related to years of low and non-inclusive growth, with associated loss of trust in the ‘establishment’.” Our nation is so polarized politically. It has been our take that no matter who won the election, as long as there was a definite result on Election Day, half of the country would wake up the next morning disappointed.

This election cycle truly has been something very different from the norm. The conventional wisdom called for Hillary Clinton to take the White House, Democrats to take back the Senate, and Republicans to hold the House. That was very far from the actual outcome of Republicans taking the White House and holding onto both the Senate and the House, albeit with slimmer margins than before the election. The major polls have now incorrectly called the two most important elections in the world in 2016. Looks like the political polling industry has some soul-searching to do.

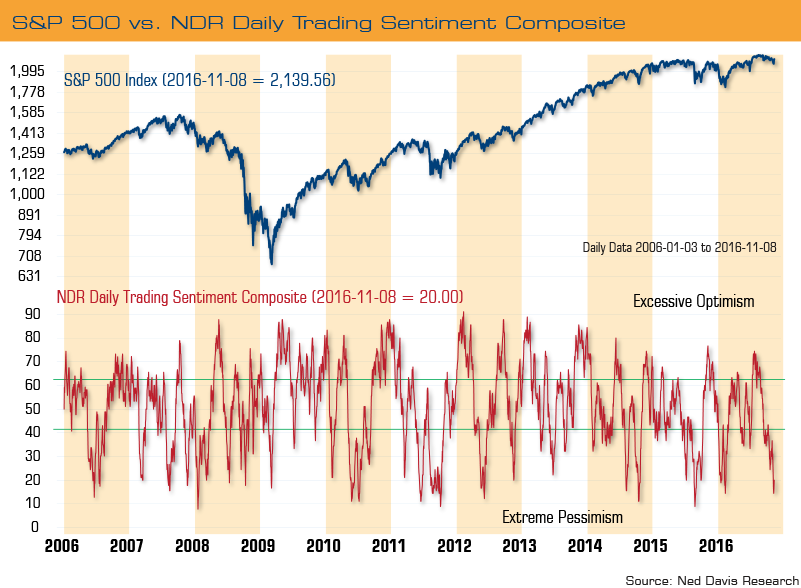

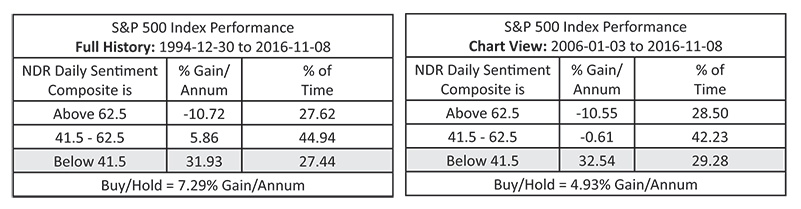

Now what do we believe this means for the markets and the economy? For the short term, it is safe to say that volatility will surge and the markets will plunge. If this truly is similar to Brexit, then we feel the decline in the markets will be a short-term event with the markets rebounding quickly. It only took a few short days for the markets to recover from the initial Brexit shock. Investor sentiment suggests that may be the case again as sentiment already resides in overly pessimistic territory. According to Ned Davis Research’s (NDR) Daily Trading Sentiment Composite, investor sentiment has really soured leading up to the election (see chart below). In particular this is due to the recent volatility, the market stalling, the FBI investigation, the surge in healthcare premiums, and divisiveness around this election.

If history is an indicator, the forthcoming combination of President and Congress may not be the best outcome for the markets. For example, only 22.5% of the time since 1900 was the government run by a Republican President and a Republican-controlled Congress. During those times, the Dow Jones Industrial Average has advanced at only a 7.03% average annual pace. In comparison to a Democratic President and split Congress — which was the odds on favorite scenario — the Dow has historically advanced at a 10.37% average annual rate.