“The factor-based Index methodology seeks to emphasize companies with the strongest relative revenue growth and price momentum, two factors that historically have been strong predictors of long-term stock performance for junior gold miners,” according to Sprott.

Given their focus on revenue growth and high beta stocks, the two factor-based gold miner ETFs may be seen as growth-oriented, betting on high-flying companies that could fly even higher.

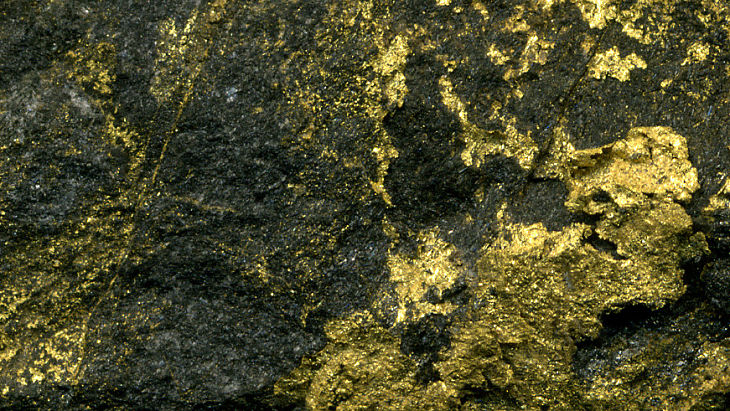

Gold miners are strengthening on rising gold prices, with gold for December delivery rising up to $1,308.2 per ounce, its highest level since October 4.

While concerns over a Federal Reserve interest rate hike have diminished the appeal for precious metals, renewed political risk on an improved outlook for a Donald Trump presidency have supported safe-haven plays.

“Politics are going to keep the market uneasy enough that there will not be aggressive selling in gold,” Peter Hug, global trading director at Kitco Metals, told the Wall Street Journal “Investors have redeployed capital into gold just in case there is a surprise Tuesday night.”

For more information on the gold market, visit our gold category.

Sprott Gold Miners ETF