In an attempt to stimulate greater trading volume in exchange traded funds, Bats Global Markets (NYSE: BATS) is adopting a cash incentive to encourage some of its largest market makers to trade more ETF shares, more frequently.

Beginning September 1, lead market makers will receive as much as $400,000 per ETF each year on the BATS exchange, depending on the average daily volume, reports Rachel Evans for Bloomberg.

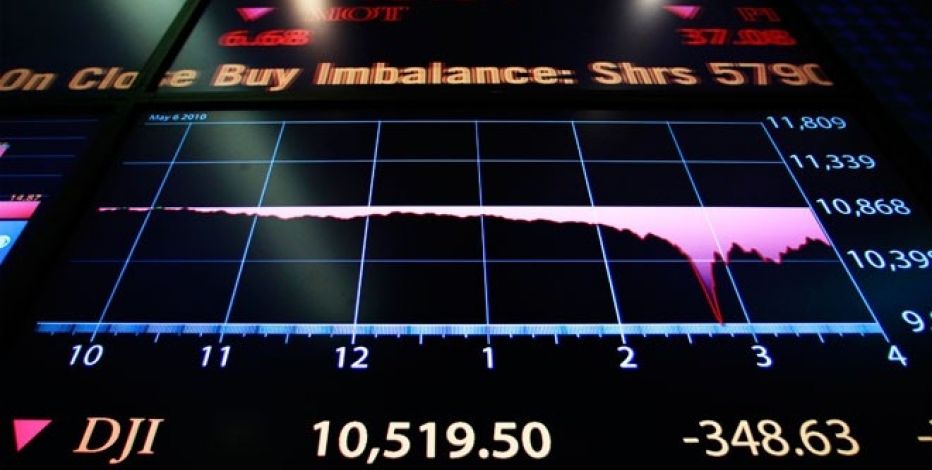

The BATS exchange previously offered a cash incentive to fund issuers to list their ETFs on the platform. The money is now offered to market makers, which is seen as a direct response to the so-called mini flash crash that pushed exchanges, fund providers and investors to support the backbone behind ETF trades.

[related_stories]Bryan Harkins, head of U.S. markets at Bats, argued that paying large traders will help keep the market liquid and orderly, even during periods of extreme volatility.

“The whole intention is to further incentivize market makers so that the business of market making is much more attractive,” Harkins told Bloomberg. “That in turn encourages them to support the market on the most volatile days.”

On August 24, heightened market volatility fueled an overwhelming percentage of sellers flooding the markets. Meanwhile, interconnected markets experienced inconsistent rules around trading halts, which affected market liquidity – an abnormally high 1,278 trades were halted. Along with the trading halts, the late New York Stock Exchange open also contributed to the reliability of pricing sources used to value derivatives.