Direxion, the second-largest issuer of inverse and leveraged exchange traded funds, announced Wednesday it has added two new ETFs to its existing lineup of leveraged and inverse ETFs.

The Direxion Daily European Financials Bull 2X Shares (Ticker: EUFL) seeks to achieve 200% of the daily performance of the MSCI Europe Financials Index.

Meanwhile, The Direxion Daily Gold Miners Index Bear 1X Shares (Ticker: MELT) seeks to achieve 100% of the inverse of the daily performance of the NYSE Arca Gold Miners Index.

Sylvia Jablonski, Managing Director at Direxion, said the company had recently seen instability in European markets, with the post-Brexit effect yet to subside as political and economic uncertainties remain.

“The launch of the European Financials leveraged ETF is timely, as market reaction to the EU situation presents the chance for bullish traders to magnify their short-term perspective,” Jablonski said. “Our new Gold Miners bear ETF will complement the existing suite of ETFs tracking that space, to give traders another option for taking advantage of short-term opportunities.”

Direxion Announces Reverse and Forward Share Splits of Nine Leveraged ETFs

Direxion also announced it will execute reverse share splits for four of its leveraged exchange-traded funds, as well as forward share splits for another five leveraged ETFs. The total market value of the shares outstanding will not be affected as a result of these splits, except with respect to the redemption of fractional shares, as outlined below.

Four Reverse Splits

Direxion will execute a 1-for-4 reverse split of the Direxion Daily Natural Gas Related Bear 3X Shares (GASX). The firm will also execute a 1-for-5 reverse split of the Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 3X Shares (DRIP), Direxion Daily Gold Miners Index Bear 3X Shares (DUST) and Direxion Daily Junior Gold Miners Index Bear 3X Shares (JDST). The splits are effective at the open of the market on Aug. 25, 2016.

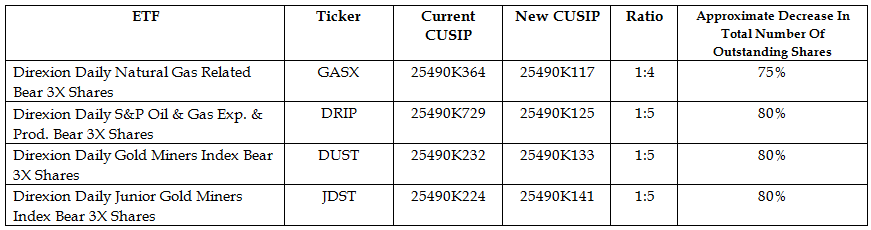

A summary of the four ETFs undergoing reverse splits is as follows (please note the CUSIP changes, effective Aug. 25, 2016):

As a result of this reverse split, every four or five shares of a Fund will be exchanged for one share as indicated in the table above. Accordingly, the total number of the issued and outstanding shares for the Funds will decrease by the approximate percentage indicated above. In addition, the per share net asset value (“NAV”) and next day’s opening market price will be approximately four- or five-times higher for the Funds. Shares of the Funds will begin trading on the NYSE Arca, Inc. (the “NYSE Arca”) on a split-adjusted basis on Aug. 25, 2016.