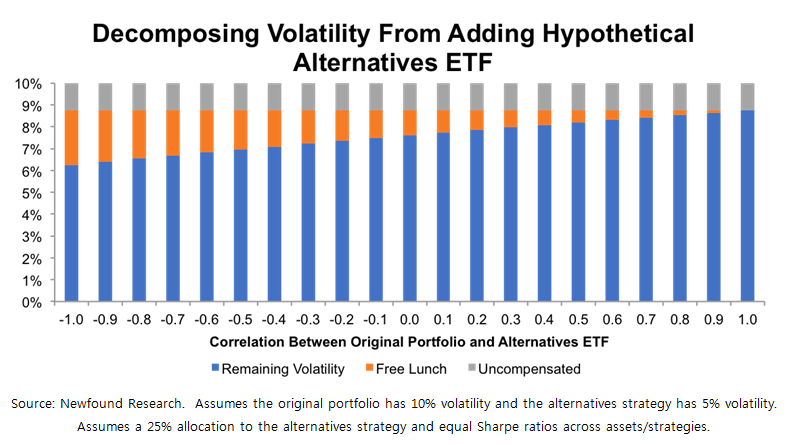

The magnitude of volatility reduction will depend on the correlation between the alternatives strategy and the existing portfolio. The lower (higher) the correlation, the more (less) volatility is reduced.

Looking to the far right of the graph below, we see that by introducing a 25% alternatives strategy sleeve, volatility is reduced from 10.00% to 8.75% in the case where the alternatives sleeve is perfectly correlated to the existing portfolio. This 1.25% is uncompensated volatility reduction: it comes at the cost of lower expected returns.

When the alternatives sleeve is less than perfectly correlated to the existing portfolio, we see that overall volatility falls below 8.75%. This reduction below 8.75% is what practitioners mean when they refer to the free lunch of diversification. It is risk reduction that comes with no additional cost. Expected returns remain the same.

If the alternatives strategy is uncorrelated to the existing portfolio (reflected in the column labeled 0.0), a 25% allocation will reduce volatility from 10.0% to 7.6% for a total reduction of 3.4%. 1.25% of this reduction is uncompensated, while 1.15% is a free lunch.

We now recreate the graph above, decomposing the original 10% portfolio volatility into three components: (1) the volatility remaining after adding the alternatives position, (2) diversification’s free lunch, and (3) uncompensated risk reduction.

In August 2014, Salient Partners published a great white paper titled “The Free Lunch Effect: The Value of Decoupling Diversification and Risk” that discusses uncompensated vs. free lunch risk reduction in much more depth.

Assuming that the investor remains comfortable with the 10% volatility risk level in the original portfolio, then we should look to eliminate the uncompensated risk reduction to isolate the free lunch benefit.

There are a number of potential ways this could happen, including:

- We add an alternatives strategy that delivers a superior Sharpe ratio to the original portfolio.

- We leverage the portfolio so that the 1.25% of uncompensated risk reduction is eliminated.

- We slot the alternatives ETF into a lower volatility portfolio sleeve like core bonds.

- We find a higher volatility version of the alternatives strategy, which would at this point in the product development cycle mean forgoing an ETF or a mutual fund.

Of these four options, I think the fourth option – finding a higher volatility version of the strategy – is both the most practical (e.g. through a mutual fund that may use more leverage) and the most certain in its payoff.

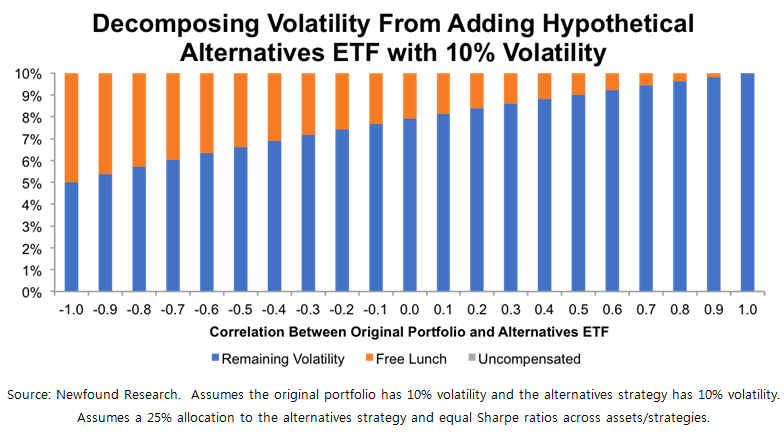

Below, we recreate the volatility decomposition from adding a 25% allocation to an alternatives strategy, but now assume the strategy has 10% volatility.

Uncompensated risk reduction has disappeared. Expected returns will be unchanged at any allocation level and any volatility mitigation is gravy.

Alternatives strategies deserve consideration in many portfolios. The ETF wrapper offers many advantages when accessing these strategies, including daily liquidity, process and holdings transparency, and relatively lower costs.

However, many of the most popular alternatives ETFs have bond-like volatility profiles because they are not designed to utilize leverage. While this volatility problem is not a fatal flaw, it does either limit how alternatives can be used within a portfolio or force investors – especially those with higher risk tolerances – to make the difficult choice between diversification and return.

Justin Sibears is the Managing Director, Portfolio Manager at Newfound Research, a participant in the ETF Strategist Channel.