Note: This article is part of the ETF Trends Strategist Channel

By Clayton Fresk

Every day there seems to be another strategic beta fund (or family of funds) coming to market, of which the newest trend appears to be multi-factor funds. It can be an intimidating task filtering through the various names to determine the differentiating factor between them all. In addition, even after running through this task, is there enough differentiation to further help make an allocation decision? I will examine the strategic beta landscape as we sit today.

In the following analysis, I used the Morningstar Strategic Beta classification system. While the system itself is not new, it is a quantitative way to slice and dice the universe. A full report outlining the classification system can be found at: https://corporate.morningstar.com/US/documents/Indexes/Strategic-Beta-Landscape.pdf

For purposes of this article, I am going to focus on Equity ETFs only. As of 5/18, there were 1126 US ETPs classified as Equity (excluding leveraged and inverse ETPs). Within this group, there were 493 classified under the Strategic Beta Group. So approximately two out of every five equity ETPs fall under the Strategic Beta umbrella.

That’s the easy part.

Now the classification gets a lot more granular. From there, the first attribute is Return Oriented, Risk Oriented, or Other. Under each of those is a subset of attributes:

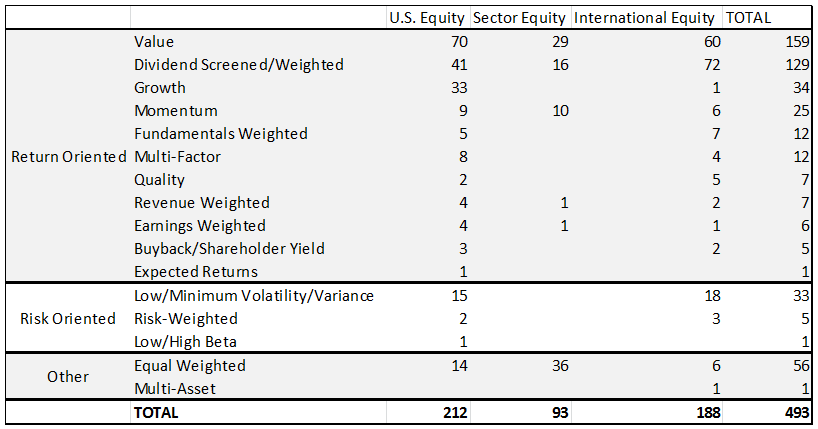

However, a single ETP can have multiple attributes within this subset (there are five ETPs that have six separate attributes attached to them). Similar to the Morningstar analysis, here is a breakdown by the 2nd level attribute, broken down by US, Sector, or International exposure:

A large majority of the names have a Return Oriented methodology with various attributes, while the other groups consist mainly of Low/Minimum Volatility or Equal Weighted names.