Note: This article appears on the ETFtrends.com Strategist Channel

By Rusty Vanneman, CFA

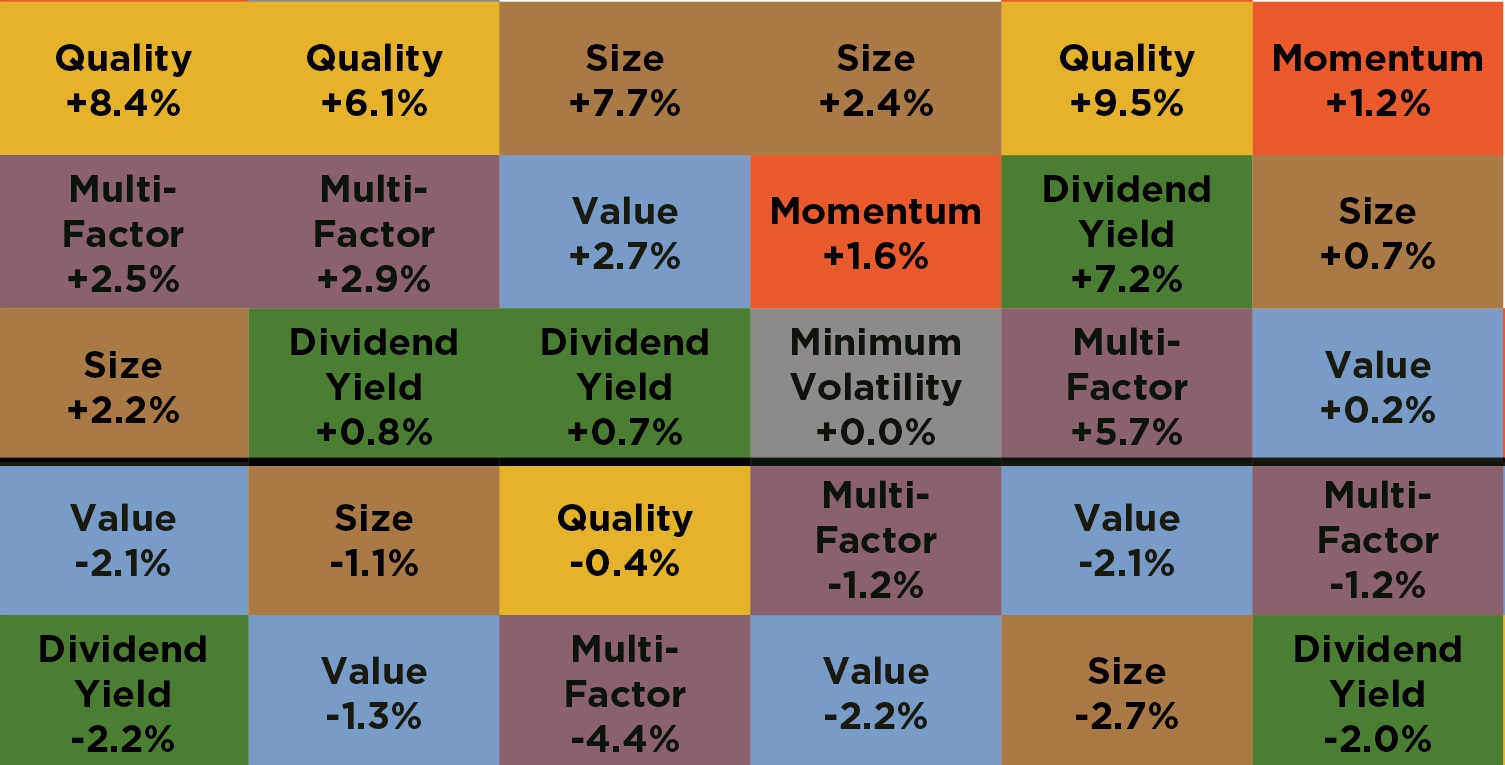

There’s a chart on factor investing that I love to use for investor presentations, but I’ve been cautioned many times not to. I’ve heard it’s “too busy” or “too confusing,” and while I totally understand that feedback, I still love it – and I think it works. To me, it’s the most powerful and succinct way to explain why money managers should emphasize factor investing (and all you have to do is follow the colors of the boxes; the words aren’t even necessary to know).

The chart (below – click to enlarge) shows what we at CLS deem the “Big Six Equity Factors” on the basis of a calendar year going back 25 years. It is prepared by iShares, and the equity factors used have been studied and white-papered by MSCI.

The chart is similar to the popular Callan Charts or Periodic Asset Allocation Charts that many in the industry love to use. But this one is better for three big reasons.

First, it shows how the different boxes representing asset classes or factors are always moving around. Depending on how you view it, the chart demonstrates either the cyclical nature of the markets (which I believe) or the randomness of the markets. Either way, it’s a powerful educational tool to teach investors to stay balanced in their portfolios and not to chase performance (the leading reason investors of all stripes experience sub-optimal performance).