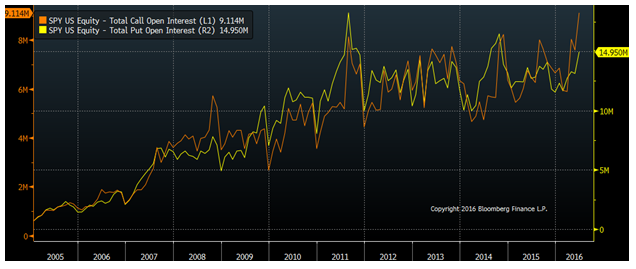

The next chart, clearly shows a rising trend in open interest for both calls and puts. Open interest now completes the picture indicating more participants. Volume may be about the same over the last five years, but a higher open interest implies positions are being held. One interpretation may be a longer holding period for options via long-term hedging or more spreads being traded as a result of tighter bid-ask spreads, or simply more end-users.

The creation of ETFs has created a world of opportunity from stock indices, currencies, sectors, commodities, and bonds and this world has been expanded through the use of options. Options are a versatile tool to control risk or enhance returns either broadly or tactically in a portfolio at a fraction of the cost of an outright ETF. Option strategies that involve hedging, overwriting, equity replacement, or cross-asset hedging have now shifted from individual equities to ETFs.

Related: Math Matters – Rethinking the Calculations Behind Investment Returns

Due to increased liquidity and open interest trends, options on ETFs provide traders and portfolio managers the ability to enter and exit positions with ease and little impact to overall pricing. The bottom line, volume engenders volume and the end result is increased liquidity leading to tighter bid-ask prices and more opportunity for all.

Chris Hausman is a Senior Trader and the Chief Market Technician at Swan Global Investments, a participant in the ETF Strategist Channel.

[related_stories]Disclosures:

Swan Global Investments is a SEC registered investment advisor providing asset management services utilizing the Swan Defined Risk Strategy, allowing our clients to grow wealth while protecting capital. Please note that registration of the Advisor does not imply a certain level of skill or training. Swan Global Investments, LLC is affiliated with Swan Capital Management, LLC, Swan Global Management, LLC and Swan Wealth Management, LLC. Disclosure notice and privacy policy.