- Looking to find ‘blood’? Find something that marries the unholy trinity of current market scorn

- How to do it? Look at emerging markets, high yield and anti-dollar

- Where? Say hello to emerging market local currency bonds – conveniently packaged in ETF format

Baron Rothschild is credited with one of Wall Street’s oldest adages: “The time to buy is when there’s blood in the streets.”

Easier said than done. Consensus can be a warm safety blanket. But as Warren Buffett has warned, “you pay a very high price in the stock market for cheery consensus.”

It is hard to quantify consensus, but one way is to evaluate how investors are voting with their dollars.

We see three big rotations occurring:

- A move out of emerging markets

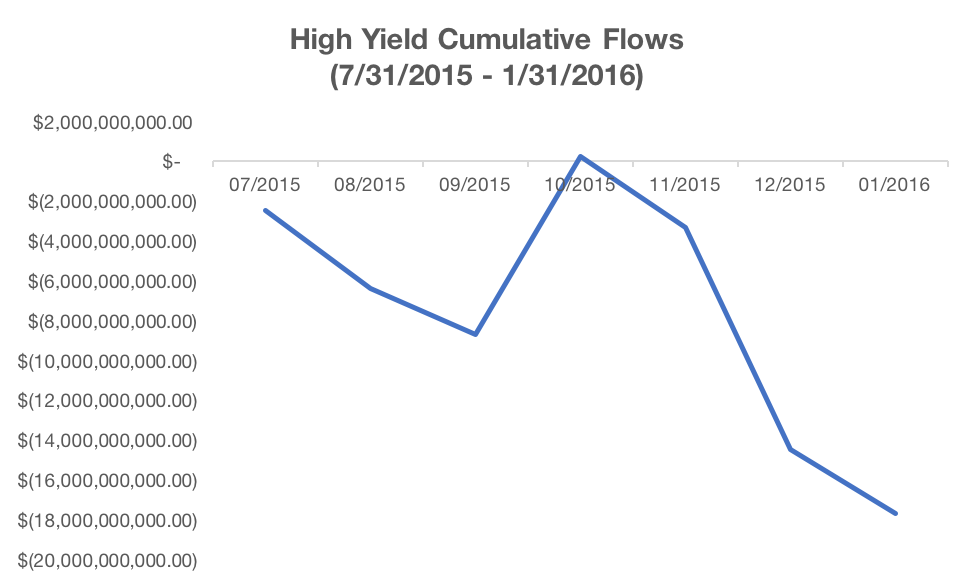

2. A move away from high yield

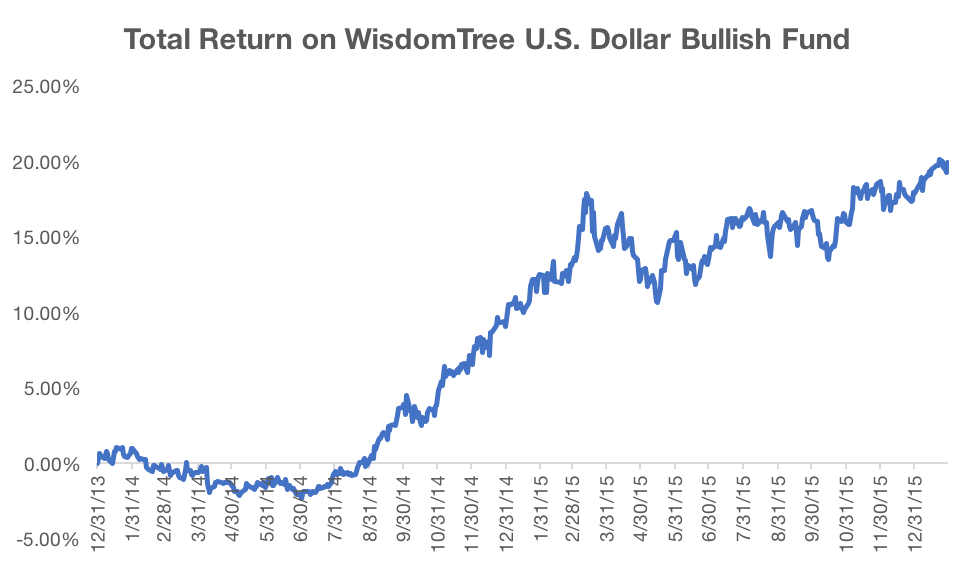

3. A move towards USD dollar-denominated assets

As with all things in a global economy, these trades are not independent. Concerns over slowing growth in emerging market economies may be driving flows to safe-haven assets in the United States. The very same economic growth has led to slowing demand for commodities, hurting the revenue of commodity producers: the very same companies issuing the majority of high yield debt.