I think it’s safe to say that the ETF marketplace has grown larger and more diverse than anyone would have imagined when the first ETF was created in 1993. Today virtually any asset class, investment style, economic sector, industry, region, or country can be accessed via an exchange traded fund. If you can imagine it, the odds are good that there is an ETF for it.

One might think that with the diversity of over 2,000 ETFs available, the ability to create superior portfolios is easier than ever. The diversity of investment choices gives the investor a toolbox with almost unlimited options. However, diversity does not necessarily mean diversification. Just because there are more potential building blocks available, doesn’t mean that at the end of the day returns and risks of a total portfolio will wind up being much different. From a portfolio construction standpoint, having more options from which to choose is not necessarily a cure-all.

Modern Portfolio Theory (MPT) is based first and foremost on the idea of correlations. When Harry Markowitz introduced his seminal work, “Portfolio Selection” in 1952, the key new concept he introduced and quantified was correlations. Markowitz was able to prove mathematically that if pairs of investments did not move in lock-step with one another, if the correlations between assets were low, then the overall volatility of a portfolio would be reduced. This is MPT in a nutshell.

And therein lies the rub. While it is true that uncorrelated investments will reduce risk, the flipside of that proposition is that highly correlated assets won’t do much of anything to reduce risk. Portfolios comprised of small positions in many highly correlated ETFs won’t have risk-return characteristics all too different than that of a single broad-based ETF.

This was illustrated when the idea of “style boxes” dominated the thinking on portfolio construction 10-15 years ago. Back then divvying up the U.S. market into styles was all in vogue. It started simply enough, with a distinction being made between large cap and small cap companies. Next people started thinking of growth stocks and value stocks as different animals. When Morningstar introduced its trademarked 3×3 style box, the ideas of midcap and blend/core was added to the equation. At that point, people started to go a bit overboard- megacaps, microcaps, and “SMID-caps” were added to the mix. Even existing styles were further subdivided… deep value vs. relative value, momentum growth vs. growth-at-a-reasonable price.

The pie charts below illustrate how equity markets were divided into smaller and smaller slices in the pursuit of diversification. But there’s one glaring flaw with this approach….the equity market hasn’t gotten any bigger as a results of these gymnastics. There are no new assets being created by this process. The same market is just being divided and subdivided into ever smaller pieces.

source: Zephyr STYLEAdvisor

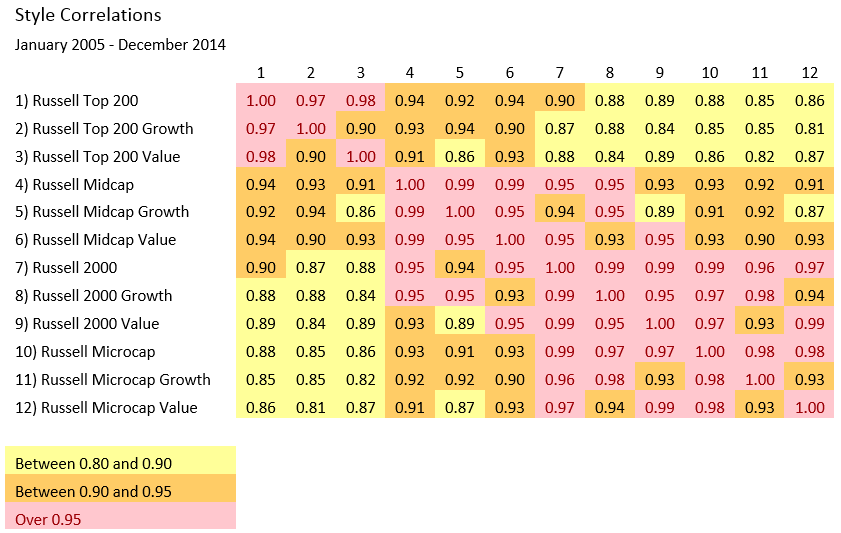

So how do these different market styles interact with one another? The correlation matrix below shows the various Russell indices that cover the entire U.S. equity market. Remember, the key to making diversification work is having low or even negative correlations. Clearly, dividing the U.S. market into smaller and smaller subdivisions does not accomplish the goal of creating diversified assets. Every correlation is in excess of 0.80, thus offering little opportunity for risk reduction.

Source: Zephyr STYLEAdvisor

The role of correlation is especially relevant when it comes to the many ETFs available. While there are certainly a lot of broad based ETFs out there representing generic asset classes, many of the niche ETFs are focused upon very small slices of the same overall pie. Another significant segment of the ETF market is the “smart beta” or “strategic beta” products. In these cases the underlying holdings of the ETFs are usually the same as their market-capitalization weighted cousins, with the only real difference being the relative weights amongst the holdings. Unless the correlations of these ETFs are low, there will be little opportunity to dampen the overall volatility of a portfolio.

This article is simply meant to be a cautionary tale, not an edict against using ETFs. ETFs are one of the most significant financial innovations over the last two decades. The ability to make very specific investments in a desired market or market segment via a liquid vehicle has greatly benefited the industry. The take-away of this piece is to simply remind investors that when it comes to portfolio construction, the math matters. Extra focus should be placed on the correlations of ETFs, especially in periods of market crisis, if the overall goal it produce a less volatile portfolio.

Marc Odo is the Director of Investment Solutions at Swan Global Investments, a participant in the ETF Strategist Channel.