The main point of the comparison was to draw parallels between the two and compare performance from the ETF strategist tactical segment to a broader implementation group. Are there similarities in return profile, risk, etc?

RESULTS FAVOR THE ETF STRATEGIST

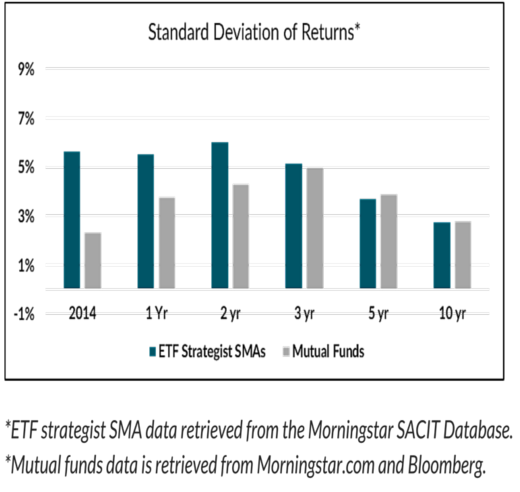

While exhibiting a moderately higher volatility profile overall, risk-adjusted returns/sharpe ratios were comparable to better over the various study periods.

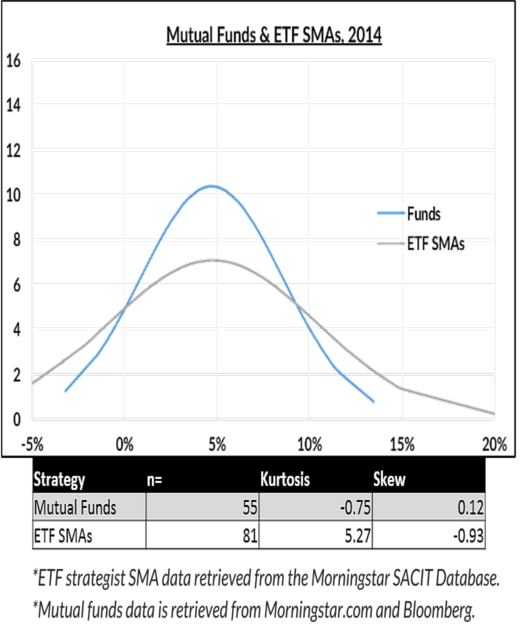

The mutual fund sample exhibited a more central tendency and negligible skew in the distribution curve for 2014 (standard deviation of returns and Kurtosis levels) as the ETF strategist had outliers illustrated by the curve (Exhibit 2). Removing the top and bottom 3 returns from the sequence for 2014 results in an almost identical skew and kurtosis profile.

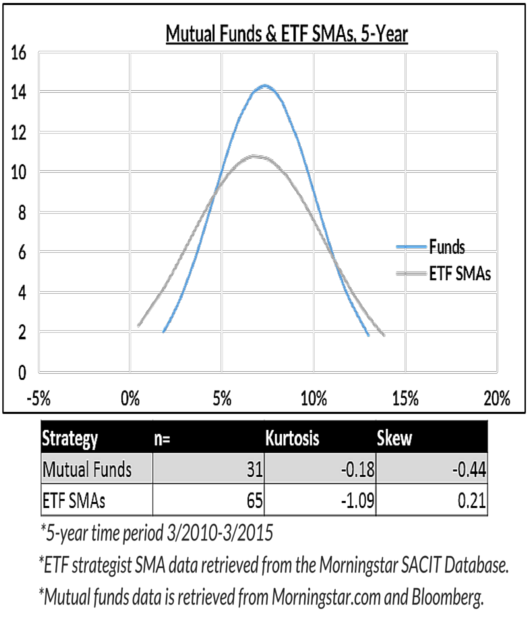

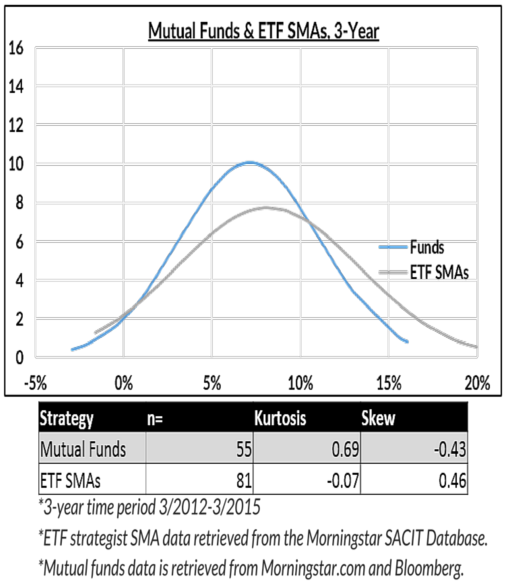

Over the 3 and 5 year periods, ETF strategists continued to demonstrate a wider deviation in returns but with a more positive skew than the mutual fund sample group.

The results support the ETF strategist group as a laudable representation of tactical strategies compared to the broader group. This was demonstrated on an absolute return basis but also on a risk-adjusted basis.

While not statistically significant in all cases, the favorable results were visually consistent over multiple time sequences (Exhibit 1), which included the 2008 recession, but also in more recent years when the integrity of the group was in question.

This result is in line with our philosophy that the significant majority of long-term strategy returns are explained by asset allocation, rather than timing or security selection. Choosing ETFs as the security selection tool lets the ETF portfolio manager pay more attention to the asset class allocation decision and overall portfolio strategy. The use of ETFs has consistently produced results that are at least equivalent, if not better, than traditional funds.

Bryan Novak is the Senior Managing Director & Portfolio Manager at Astor Investment Management, a participant in the ETF Strategist Channel.

DISCLOSURE

All information contained herein is for informational purposes only. This is not a solicitation to offer investment advice or services in any state where to do so would be unlawful. Analysis and research are provided for informational purposes only, not for trading or investing purposes. All opinions expressed are as of the date of publication and subject to change. Astor is not liable for the accuracy, usefulness or availability of any such information or liable for any trading or investing based on such information. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve results that are similar to those shown. Factors impacting client returns include individual client risk tolerance, restrictions a client may place on the account, investment objectives, choice of broker/ dealers or custodians, as well as other factors. Any particular client’s account performance may differ from the program results due to, among other things, commission, timing of order entry, or the manner in which the trades are executed. Clients may not receive certain trades or experience different timing of trades due to items such as client imposed restrictions, money transfers, inception dates, and others. The investment return and principal value of an investment will fluctuate and an investor’s equity, when liquidated, may be worth more or less than the original cost.

The performance presented is publicly available on Morningstar.com and should not be viewed as the performance of Astor’s strategies or as an indication of the performance of Astor’s strategies. The performance shown for ETF Strategists represents composite performance reported by investment managers to the Morningstar SACIT Database following the criteria listed. Astor makes no representation of the accuracy or completeness of the performance record of these managers. Additionally, the fee structure and method of composite creation will vary across the different managers. The performance shown is represented to be GIPS compliant by the reporting parties. Astor makes no representation as to whether the reporting parties are GIPS compliant or not. The performance shown for the mutual fund category represents performance reported to Morningstar by individual registered investment companies organized under the 1940 Investment Companies Act. Astor makes no representation of the accuracy of this performance. Similar to the ETF Strategists, the fees of these funds will vary according to the underlying structure and share class of each fund.

A complete list of the constituents for each category is available upon request.

308151-301