Real estate investment trusts (REITs) in the US took the lead in last week’s shortened holiday trading week for the major asset classes via a set of proxy ETFs. Vanguard REIT (VNQ) climbed nearly 1.0%, a comfortable edge over last week’s number-two performer for the four trading days through Friday, Nov. 27: Vanguard Total Stock Market (VTI), which tracks US equities.

The big loser last week: emerging market stocks, based on the hefty 3.5% setback (in US$ terms) for Vanguard Emerging Markets (VWO). Equities in emerging-markets have stabilized in recent weeks after falling sharply this year from May through the end of September. But the latest slide suggests that VWO is still suffering from a bearish trend. Earlier this month I noted that the rally in these stocks looked “unconvincing” and the analysis still stands as we head into the final month of the year. At some point the value play that’s brewing in these countries will offer an attractive buying opportunity. But gravity is still the prevailing force for these assets overall.

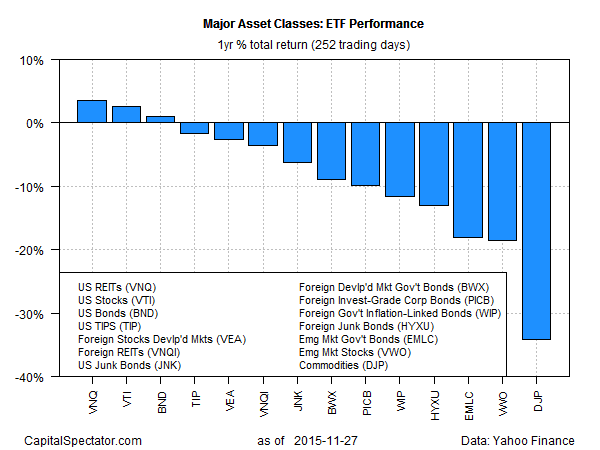

US REITs, by contrast, are in the lead for the one-year as well as one-week summary through Nov. 27. The fund is higher by 3.5% in total-return terms. That’s a modest gain, but for the moment it stands as the top of the heap for the one-year ledger. Meantime, US stocks (VTI) are again in close pursuit via second place, posting a 2.6% gain for the trailing 252-trading-day period.

Nonetheless, the losers continue to dominate the performance summary over the past year. Indeed, most of the proxy ETFs for the major asset classes are weighed down with varying degrees of loss. Broadly defined commodities are still the red-ink leader. The iPath Bloomberg Commodity (DJP) is off by a steep 34% for the year through last Friday. Although the bear market in this corner has been roiling commodities for several years, there are still few signs that negative momentum has ended.

“As many commodities trade close to production cost levels, it’s tempting to look for a bottom,” according to Citi’s 2016 outlook for commodities. “That looks fine for a number of sectors, but should not work across the complex.” Recent price action for DJP certainly offers no reason to argue otherwise at the moment.