Second, discernible inflation-hedging characteristics—one of the most desirable characteristics of infrastructure investing5—are present for historical infrastructure equity buy and hold approaches, with a 47 bps monthly excess return in high inflation scenarios seen over broad equity from 2004-2014.

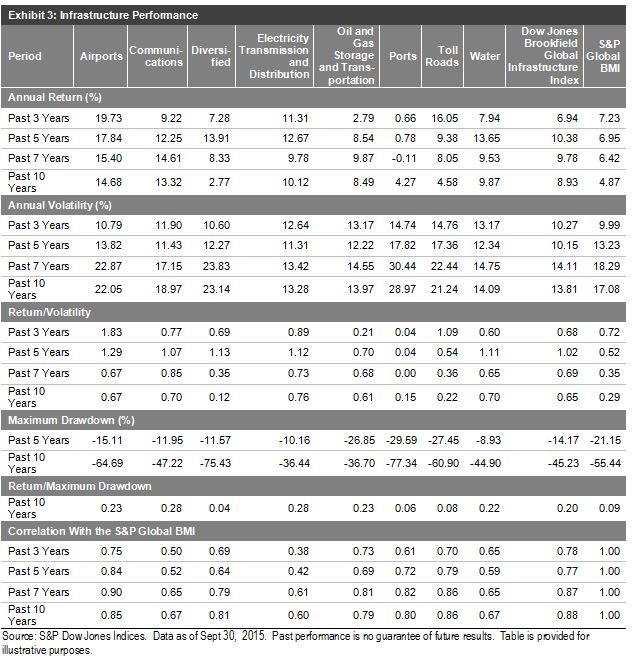

Of course, equity exposure comes with equity risk, although the average 10-year annualized volatility of 13.8% for infrastructure equity versus 17% for global broad equity, along with the notably reduced maximum drawdowns for infrastructure, is observed.

In recent times, such notable names as AP4 and NZ Super have invested in infrastructure through listed securities.8 With exposure to desirable characteristics of return and inflation protection also possible in the cost efficient, indexed manner so many pension funds now embrace, listed markets could bridge the perceived governance and expertise gap bringing the asset class in closer reach to even the smallest funds without the (toll) fees that have historically been the norm.

– See more at: http://www.indexologyblog.com/2015/11/20/listed-infrastructure-bridging-the-inflation-hedging-gap/#sthash.VSP2Bbm4.dpuf