According to a story in Canada’s Globe and Mail, one drug maker is about to take on an entire country to protect its right to price drugs the way they see fit. Alexion Pharmaceuticals, the maker of the drug Soliris, has announced a lawsuit against Canada’s Patented Medicine Prices Review Board after the board began hearings in June to pressure Connecticut-based manufacturer Alexion Pharmaceuticals to lower the drug’s “excessive” price. The Globe and Mail reports that, “the drug—dubbed the world’s costliest treatment for two rare, life-threatening blood and genetic disorders—is reportedly priced at between USD 500,000 and USD 700,000 annually per patient.”

According to the article, only two countries in the Organization for Economic Cooperation and Development have open pricing on drugs, the U.S. and Chile. Canada’s regulation of overpricing of patented drugs dates back to 1987, with the establishment of the Patented Medicines Prices Review Board, a regulatory oversight body that has been granted the right to review and control prices of drugs still under patent, and it is a negotiated feature of the North American Free Trade Agreement established in 1994. Prior to the free trade agreement, drug companies had much less protection against patent infringement by generic drug manufacturers long before their U.S. patents expired.

How effective has this board been at controlling overall drug prices in Canada? By comparing the unit cost of brand drugs sold in Canada since 2009 to those sold in the U.S. (as measured by the S&P Healthcare Claims National Index), we can determine that on average, brand name drug prices have escalated 132% in the U.S. versus 23% in Canada. Even if we remove 2014, when specialty drugs accounted for an increase of almost 30%, the six-year increase is still 119% in the U.S. versus just 18% in Canada. Exhibit 1 illustrates the difference in cost increases in unit costs for both countries.

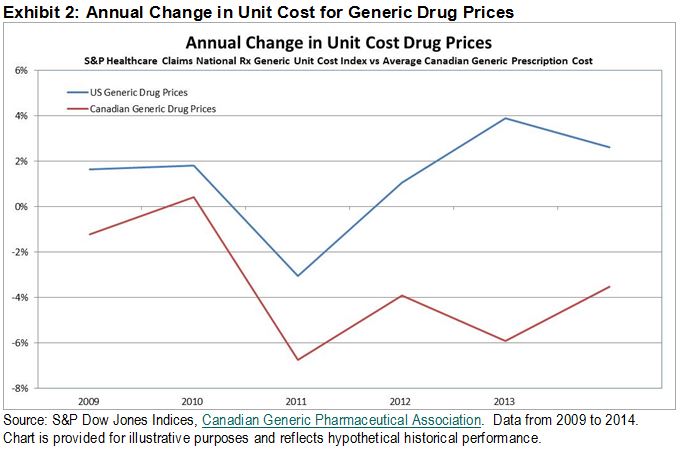

When comparing these cost increases to the average change in generic drug costs over the same period, we can see that open and competitive markets have led to a cost escalation of 8% in the U.S. and a 19% decrease in average costs of in Canada. Taking these results into account, it becomes apparent just how important this lawsuit is for Canada, however U.S. lawmakers may want to take notice as well. With a well-documented example from our neighbors to the north, a regulated market may be one potential solution for cost control for brand name drugs in the U.S. market.