US stocks reclaimed the top spot in last week’s performance race for the major assets classes, based on a set of proxy ETFs. The Vanguard Total Stock Market ETF (NYSEarca: VTI) gained 1.7% for the five trading days through Oct. 23, the fourth straight weekly rise—the longest winning streak in a year. Otherwise, the week just passed was mixed for the major asset classes, with broadly defined commodities—iPath Bloomberg Commodity (NYSEarca: DJP)—leading the losers with a 2.7% loss—the biggest weekly slide since August.

Most of last week’s gains were in stocks, although high-yield bonds inched higher too. The prospects of more (or ongoing) monetary stimulus was a factor in bidding risky asset prices up. The crowd decided that the Federal Reserve would continue to delay an interest rate hike, perhaps into 2016. Meanwhile, the Bank of China on Friday announced a rate cut in an effort to juice its economy after a run of economic reports that reflect slowing growth.

In addition, the European Central Bank (ECB) last week hinted that it would roll out additional stimulus efforts next month to bolster a softer trend across the Eurozone. “The risks to the euro area growth outlook remain on the downside, reflecting in particular the heightened uncertainties regarding developments in emerging market economies,” ECB President Mario Draghi warned last week.

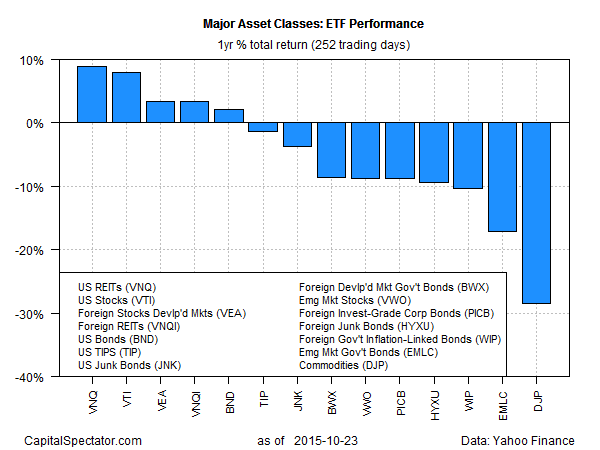

The latest weekly rally in US stocks is once again providing a rosy glow to the trailing 1-year return. VTI is ahead by 7.9% for the year through Oct. 23—second only to US real estate investment trusts–Vanguard REIT (VNQ), which is up 8.9% in annual terms through last Friday.