“I don’t agree with you Jodie…..Gold is in a bear market….too early to put some money in the yellow metal….” is a comment from the article recently posted by the Economic Times asking the question, “Where do you see the gold prices making a bottom as every fundamental turns unfavorable for gold?”

We love your comments expressing your opinions about where the market is and where it’s going, just as much as we love to share the history lessons told through our indices.

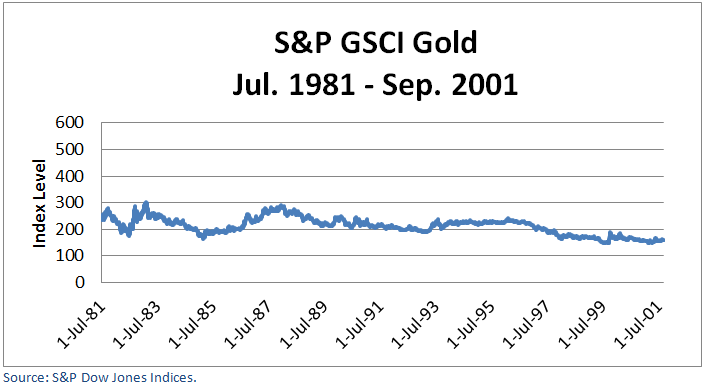

Let’s pretend today is sometime in the middle of 1981. President Reagan just established the Gold Commission that rejected returning the U.S. to a gold standard. The Fed raised rates to 20% and inflation fell. But that created a recession. Gold investors lost about half their asset values. They wondered, “Had gold reached its bottom?”

To understand the answer to this question, investors might consider the underpinnings of the prior bull run of over 400% that started when Nixon took the dollar off the gold standard in 1973. Inflation tripled, the dollar crashed, and after years of erratic monetary policy, investors piled into gold as a safe haven. The perfect environment for gold ended and investors wondered about the future of gold without these supports.

For the next 20 years, gold lived through mostly expansionary periods. Even as investors abandoned gold for stocks, gold didn’t fall much further.

Not until Sep. 11, 2001, did fear ripple through the market, triggering the flight to safety into gold again. The drivers of inflation and a weak dollar that supported gold through the 1970’s bull run were back. These factors plus the global financial crisis and worries about government reform led gold to a record high. Such forces in addition to the growing popularity of the gold ETF as a new way for investors to access gold sent gold soaring more than 600% over the next ten years, until Aug. 2011.

As worries eased, investors fled gold once again. However, many in this selloff have no memory of the 65% drop that happened in 1981-82. Currently, gold has only lost 45% since its peak four years ago, but the majority of the loss happened in 2013 when gold dropped 28%, the most since 1981.