Socially responsible investment mandates have gradually worked their way into the investment world. The most prominent example might be the divestiture of companies that are involved in the expansion of mankind’s carbon footprint, i.e. the Energy Sector. At the same time, there is often a need to use listed derivatives to achieve the investment outcome. Example might include the need to equitize cash in the portfolio or manage the inflow and outflow of cash effectively to avoid cash drag. Luckily, this can be accomplished with index futures such as those listed for trading at CME Group. For example, one can easily replicate the S&P 500 ex-Energy with just the E-mini S&P 500 futures and the E-mini S&P Energy Select Sector Futures.

On August 12, 2014, the energy sector represented approximately 7.3% of the S&P 500 index. Thus, for a $100 million-portfolio, approximately $7.3 million is tied up in the energy sector that is slated for divestiture under the social mandate. Simply selling short the equivalence of $7.3 million worth of E-mini S&P Energy Select Sector Index futures, or any other derivatives replicating that sector, is not the answer. If that was the only action taken, the resulting investment portfolio would be under invested… indeed by the same $7.3 million.

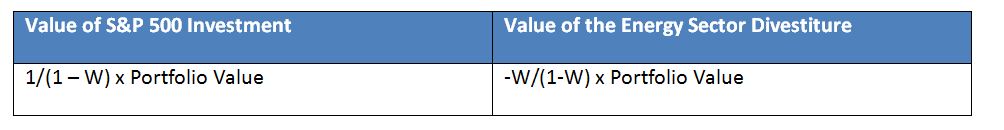

Thus additional investment needs to be made to bring it back to full deployment. If we denote the weight of the energy sector as W, the correct “hedge ratio” should be: