I was intrigued by the recent Barron’s cover story on robo-advice. The Barron’s article described example portfolios for Betterment, Charles Schwab, Vanguard Personal Advisor Services, and Wealthfront. As I mentioned in my last post, robo-advisors are power-users of indexing and ETFs. So I thought that it would be interesting to compare and contrast some of the ETF holdings of two of these robo-advisors, with my assumption being that the portfolios that these robos would construct will be bare-bones, no frills core portfolios. Emerging and mass affluent clients currently are underserved with regard to strategic asset allocations.

The Barron’s article had me expecting to find that the RIAs Betterment and Wealthfront held 10-12 ETFs for their clients. Not the case. I was surprised by the breadth of their ETF holdings and by the percentage of assets which they have committed to index-trackers.

Cerulli data from EOY 2014 indicates that RIAs, on average, have approximately 20% of client assets in ETFs. So these two robo-advisors are at roughly 400% of the average.

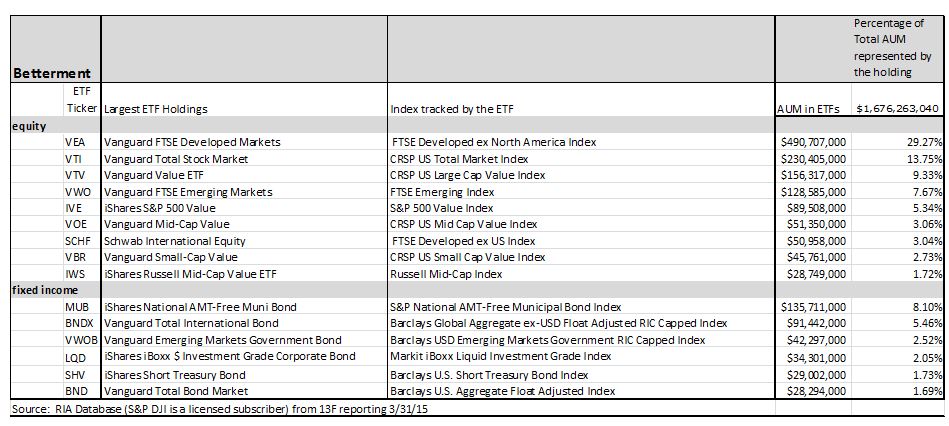

Next, I wanted to see how these two robo-advisors are using indexing and ETFs to create core portfolios. To be clear, I can only see the aggregate of their holdings, not individual client accounts. Based on their average client size ($20,192 for Betterment and $75,636 for Wealthfront) and the amount of AUM in certain ETFs, I can draw some conclusions about the ETFs which are most commonly recommended by these two robo-advisors: