From the first quarter of 1995 through the end of 2014, a span of 80 quarters, a 1.25x leveraged version of the S&P 500 in about 60 of those 80 quarters. The difference is even more pronounced with small-caps where the 1.25x leveraged version of the Russell 2000 outperforms its unleveraged counterpart by nearly 44 basis points per quarter, according to Direxion data.

If LLSC, the lightly-levered small-cap ETF, had been around since 1995, it would have outpaced the traditional Russell 2000 in nearly two-thirds of the quarters through the end of last year. [A Gentler View of Leveraged ETFs]

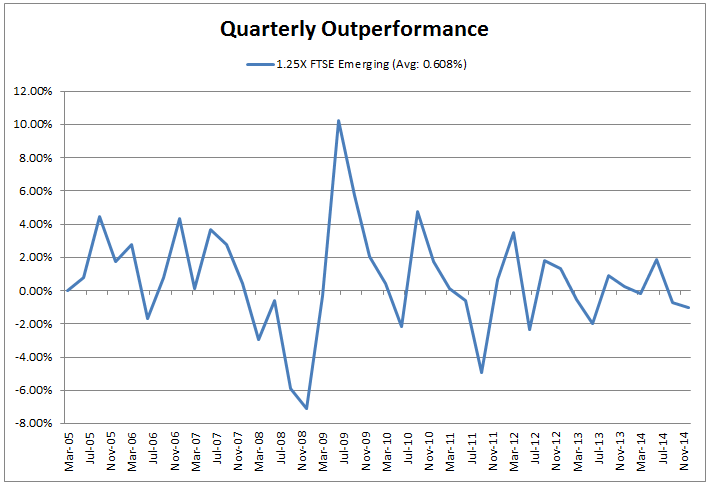

The outperformance offered by lightly-leveraged ETFs is not confined to U.S. boarders. Direxion’s backtested results of 1.25x leveraged versions of the FTSE Developed ex North American Index and the FTSE Emerging Markets Index date back to March 2005 and the results are solid.

Applying 1.25x times leveraged to the FTSE Developed ex North American Index, the benchmark for the Vanguard FTSE Developed Markets ETF (NYSEArca: VEA), results in quarterly outperformance of almost 25 basis points. The advantage is even wider when adding that extra bit of leverage to the FTSE Emerging Markets Index. In that instance, a 1.25x leveraged version of that index delivered quarterly outperformance of almost 61 basis points, according to Direxion data.