Factor investing is a well-documented method of generating excess returns, but some of the practical aspects of it are often overlooked in academic research, which tends to focus on “pure” premiums. Investors wanting to access these factors – size, value, volatility, momentum, etc. – are presented with a number of investment alternatives that aim to harvest the factor premium in different ways, and deciding which to utilize can be difficult.

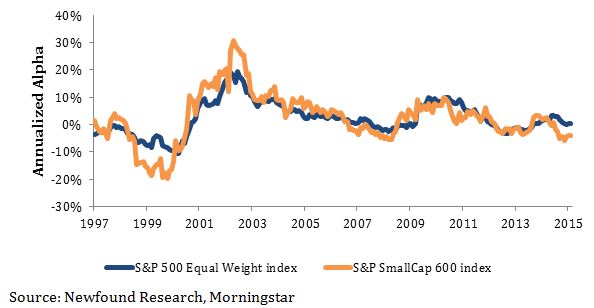

For the size premium, one obvious choice is an ETF tracking the S&P SmallCap 600 index. However, other options may look surprisingly similar. The chart below shows the S&P SmallCap 600 index along with the S&P 500 index and the S&P 500 Equal Weight index.

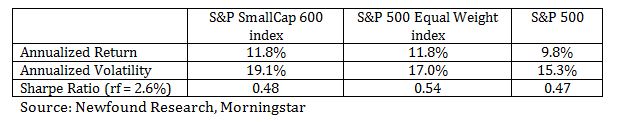

Performance statistics of the three indices over the period from January 1995 to February 2015 are shown below.

From this we can see that the equal weight version of the S&P 500 behaved a lot like the S&P SmallCap 600 with slightly better risk-adjusted returns.

If we look at the alpha of these two indices over rolling two year periods, we see that they exhibit very similar trends. The average alpha for the S&P SmallCap 600 index was 2.5% compared to 2.4% for the S&P 500 Equal Weight index, but the S&P SmallCap 600 index’s alpha was over 50% more volatile.