The S&P GSCI 2015 Rebalance Preview marks a historic shift in the benchmark renowned for its world production weight. According to this announcement of pro-forma weights, Brent crude oil is targeted take over WTI‘s status as the leading oil benchmark and the most heavily weighted commodity in the S&P GSCI. This is the first time since 1997 that a commodity other than WTI crude oil is set to be the most heavily weighted. (Natural gas was greater at times from 1994-7.)

In 1987, WTI was added to the S&P GSCI with a target weight of roughly 35% that declined to 32.6% by the end of that year. Brent was added in 1999 with a weight of about 7.5%, and by that year’s end it grew to 10.9% while WTI’s weight fell to 26.3%. Since then, WTI’s weight had grown to 40.6% by June 2008 but dropped to 25.5% as of 9/30/2014, replaced quickly by Brent which continued has continued to rise to its current level of 22.9%. Its pro-forma 2015 target weight of 24.7% is almost double its 2008 weight and more than 3x its weight from initiation.

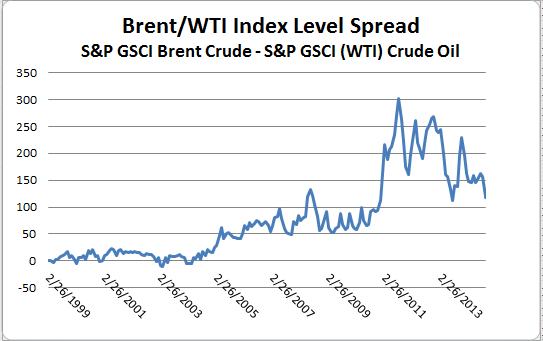

The dynamics of the crude market have changed, especially since 2010, as unconventional crude and liquids have seen an explosive growth in production from shale oil fields in Texas, North Dakota and also from increased Canadian imports. This increased supply of crude oil resulted in bottlenecks and oversupply at the Cushing pipeline nexus, which put pricing pressure on WTI. Now, pipeline capacity has been increased and transportation improved to reduce the Brent premium. The chart below shows the premium collapse in index terms that in dollar terms translates from a high of about $20 to near parity today.