As highlighted in Figure 3, an index comprised of companies with increasing dividend growth has handily outperformed the broader market. While past performance does not translate into future results, it is interesting to see how the relationship fares compared to the level of sovereign bond yields. What is clear is that as yields have decreased in 2014, investors have rewarded the shares of dividend growers even without considering dividends into the performance equation. Going forward, investors may continue to reward dividend growers, especially on a global basis as they provide exposure to companies that have the commitment from management and the means to reward shareholders with a return of capital. A global approach also allows for diversification across geographies and sectors, which will likely be in favor as the global economy continues to recover, driving earnings growth. Interestingly, an index of global dividend growers is undervalued relative to the broad global equity market, which is likely to be contrary to many expectations as we often hear how rich the stocks are.

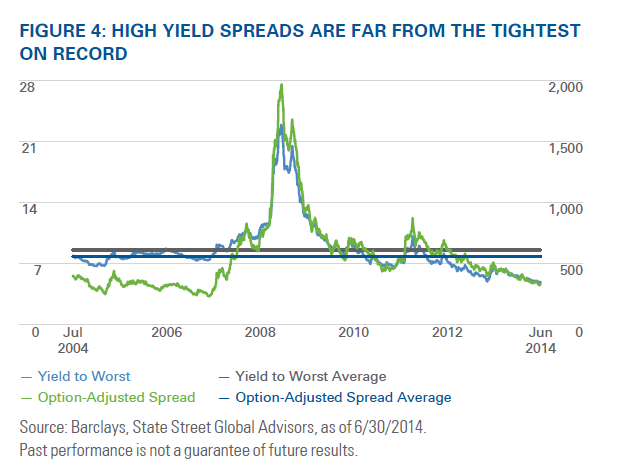

Many investors have made similar comments about high yield even, arguing that the asset class needs a new name because yields are so low. But yield levels tell investors little about the valuation of credit instruments. A better measure would be the option-adjusted spread level as it takes into consideration the difference between high yield bonds and risk-free Treasuries. Under this framework, we can see that high yield is certainly not inexpensive relative to its history, but is far from exceedingly overvalued. This puts investors between a rock and a hard place. Does one avoid the favorable income that high yield bonds can deliver in today’s market or invest knowing the opportunity may be limited? As the not too hot, not too cold economic environment remains favorable to below investment grade issuers and defaults appear poised to stay benign, one approach may be to introduce or overweight active products that can navigate a market where opportunities may become less broad-based. A risk-managed active approach can pair well relative to low cost passive exposures, but may be able to take advantage of dislocations should they arise as investors digest the end of the Federal Reserve’s tapering program. In addition, as certain issues may become mispriced, relative valuation opportunities exist across the credit spectrum for active managers seeking additional opportunities.

LOOKING AHEAD

At the midway point in 2014, global economic expansion looks likely to accelerate this year, with potential risks to the downside remaining of greater concern than those on the upside. In light of this, there is reason to believe that equities will continue to outperform credit and credit will continue to outperform sovereign bonds, as confirmed by ETF flows. Looking ahead, investors may want to avoid overly consensus opinions and look for opportunities within and across markets as popular opinions may become stretched in a world awash in liquidity.

At the midway point in 2014, global economic expansion looks likely to accelerate this year, with potential risks to the downside remaining of greater concern than those on the upside. In light of this, maintaining a view that equities will outperform credit and credit will outperform sovereign bonds continues to seem opportune and is being confirmed by ETF flows. Looking ahead, investors may want to avoid overly consensus opinions and look for opportunities within and across markets as popular opinions which could become stretched in a world awash in liquidity. Those seeking yield must especially tread with caution as investors have a tendency to sacrifice yield at the expense of total return. With that being noted, opportunities continue to exist for investors to generate income in their portfolios whether it is within or across asset classes.

Implementation Ideas

– SPDR® S&P Global Dividend ETF (WDIV)

– SSgA High Yield Bond Fund – Class I (SSHJX)

– SPDR SSgA Income Allocation ETF (INKM)

David Mazza is vice president and head of ETF investment strategy, Americas, for State Street Global Advisors, which manages the SPDR ETFs.