In some respects, this edition of MUNI NATION might be looked upon as a sequel to one of my recent posts. What I want to build on further is the theme I’ve been noticing ― optimism over the U.S. economy ― and what I believe it might mean for municipal bond creditworthiness.

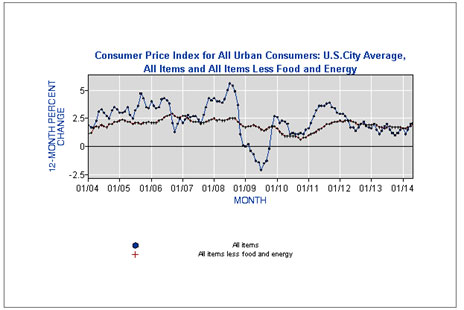

Total nonfarm payroll1 employment rose by 217,000 in May 2014, and the unemployment rate remained unchanged at 6.3% for the month, following a decline of 0.4% in April. This is better than the recession levels of three and four years ago. While housing has offered mixed results, perhaps due in part to the brutal winter experienced by a large part of the country, inflation as measured by the Consumer Price Index2 (CPI), has remained relatively low at 2.0% (unadjusted for the 12 months ended May 2014)3 .

Source: Bureau of Labor Statistics, Current Employment Statistics Survey as of May 2014.

Source: Bureau of Labor Statistics, Consumer Price Index as of May 2014.

With modest U.S. growth expectations going forward, the outlook for creditworthiness in the muni market could be one tinged with some optimism. With activity and spending on the rise, the health of local economies may improve. Indeed, as suggested on June 6, 2014 by Michael Hanson, U.S. economist for Bank of America Merrill Lynch (BAML), 10 of the 12 national economic strength indicators he follows have been showing signs of improvement.

Philip Fischer, a municipal strategist (also of BAML), offers an analysis showing a figure for state and local tax revenues 2.7 times that of our national gross domestic product (GDP) for the period ended May 2014. The analysis also suggests that, as the nation’s economy has grown, the economic activity at the local level has grown at nearly three times the national rate. If the pattern repeats, then we may begin to see the rising tide of broad-based improvement in employment and consumption which may be a contributor to stabilization in the finances of certain issuers of municipal bonds that are dependent upon a healthy tax base in real estate and local merchandizing.

1Nonfarm payroll is a statistic researched, recorded, and reported by the U.S. Bureau of Labor Statistics intended to represent the total number of paid U.S. workers of any business, excluding the following employees: general government employees, private household employees, employees of nonprofit organizations that provide assistance to individuals, and farm employees. This monthly report also includes estimates on the average work week and the average weekly earnings of all nonfarm employees.

2CPI is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. The CPI is calculated by taking price changes for each item in the predetermined basket of goods and averaging them; the goods are weighted according to their importance. Changes in CPI are used to assess price changes associated with the cost of living.

3Source: U.S. Bureau of Labor Statistics as of May 2014.