Exchange traded funds are gaining popularity as a low-cost, efficient vehicle to access various market segments. As the ETF universe expands, institutional and financial advisors are becoming more accustomed to using so-called smart-beta investment tools.

In a recent recent webcast, The Evolution of Smart Beta ETFs: Smart Beta ETFs Poised for Growth, Robert Ross, ETF Institutional Consultant for Invesco PowerShares, pointed to increased interest among pensions, endowments and foundations for smart-beta ETF strategies in both their tactical and core allocations.

“PowerShares’ brand is really about providing investors more intelligent exposure to markets, rather tan just strictly cap-weighted beta,” Ross said, quoting H. Bruce Bond, founder & former president and CEO of PowerShares Capital Management.

For instance, the PowerShares Dynamic Market (NYSEArca: PWC), the first quantitatively constructed “intelligent” ETF launched in 2003, tracks companies with superior risk-return profiles based on fundamental growth, stock valuation, investment timeliness and risk factors. Over the past ten years, PWC has generated an average annualized return of 8.3%, compared to the S&P 500’s 7.7% return.

In a survey conducted by RIA Database and ETF Trends on ETFs with almost 500 financial advisors, over half of respondents categorize smart-beta investments as those that seek to outperform a benchmark or reduce portfolio risk, track non-capitalization-weighted methodologies and include fundamental factors.

While smart-beta index-based ETFs have been around for over a decade, institutional investors are just beginning to pick up the strategies, with the majority of smart-beta ETF users, around 70%, only using these ETFs for less than three years, Tonny Ferreira, SVP, Sector Lead, Wealth Management Group at Market Strategies International, said in the webcast. [Institutional Adoption of Smart Beta ETFs on the Rise, Says Russell]

Looking at smart-beta usage among institutional investors, 24% included smart-beta ETFs in their investment portfolios. Of the smart-beta users, around 77% of institutional smart-beta investors have stuck to high-dividend strategies, while 60% follow a broader fundamental weighting methodology and 53% track some form of low-volatility index.

“The need to reduce portfolio volatility and access higher beta strategies are driving Smart Beta ETF Usage among institutional decision makers, while fee reduction and portfolio completion are more likely to drive usage of more traditional ETFs,” Ferreira said in the webcast.

Among institutional decision makers, 53% expect to increase smart-beta ETF allocations over the next three years while 46% of non-users play to explore the idea of smart-beta ETFs in their portfolios.

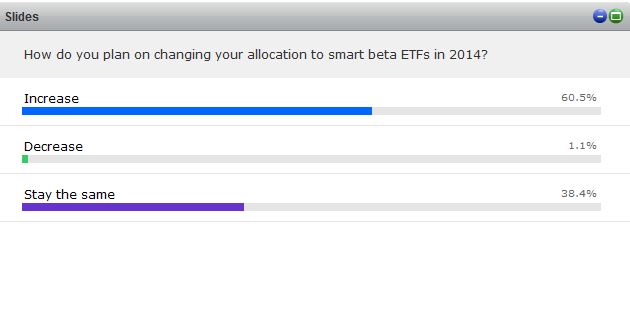

Financial advisors have a similar mindset. In the RIA and ETF Trends survey, around 61% of respondents plan to increase their allocations to smart-beta ETFs this year and 38% say they are comfortable with their current exposure to smart-beta strategies while 1% plan to cut back on smart-beta investments.