While fund managers, financial advisors, and a growing population of domestic and international investors appear to remain fixated on all things Puerto Rico, the municipal bond marketplace generally has posted positive performance so far this year for those who have remained invested and focused on the broader fundamentals.

Municipal bond returns in every sector were up modestly in the month of February, building on the good start to 2014 that we saw in January. Despite the negative headlines, the best performing part of the municipal bond market has been Puerto Rico. The Barclay’s Puerto Rico Municipal Bond Index returned 6.76% year-to-date as of February 28, 2014.

Source: Bloomberg. Data as of February 28, 2014.

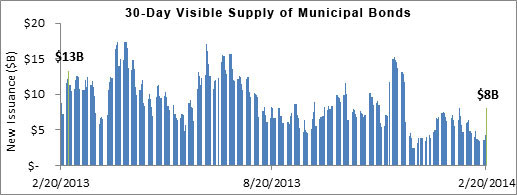

New issuance, however, has been tepid. Additionally, as illustrated in the chart below, total supply for February was nearly 50% lower than in February 2013. Flows into municipal bond mutual funds and ETFs have been net positive in 2014. Furthermore, the municipal yield curve is steep and the ratio of municipal yields to Treasury yields continues, in my opinion, to support the argument for municipal bonds.

Source: Bloomberg. Data as of February 20, 2014. The 30-day visible supply is compiled daily from both the competitive and negotiated bond offerings calendars. It reflects the dollar volume of bonds expected to reach the market in the next 30 days. Issues maturing in 13 months or more are included.

I believe the income generated by municipal bonds, on a taxable-equivalent basis, continues to be very attractive. All of the foregoing has fostered what I see as a decent environment for potentially finding value in the asset class.

Municipal bond ETFs have seen intraday-trading volumes pick up in February as compared to volumes seen in the past few months. The long-term municipal to Treasury yield ratio is in excess of 100% for AAA bonds maturing 15 years and longer, which seems to me evidence of investors asset allocating to reduce duration, or sensitivity to changes in interest rates.